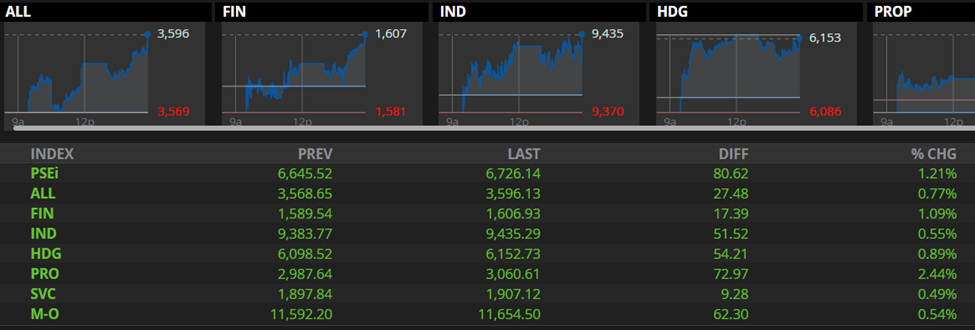

The PSE market closed higher on Friday as it ended the week with a green candle. The index move up today by 1.21%. The market is seen to digest the proclamation of Philippine next president Bongbong Marcos (BBM) and the announcement regarding the appointment of Banko Sentral ng Pilipinas, BSP Governor Diokno as the next Finance secretary. BSP Governor Benjamin Diokno will succeed Carlos Finance Secretary Dominguez III.

The index closes to 6,726.14 and formed a higher low formation on its technical charts. This is the second day that the market closed with a net foreign buying. Today it closed with 160.1Million net foreign buy and yesterdays closed with 300Million net buyers.

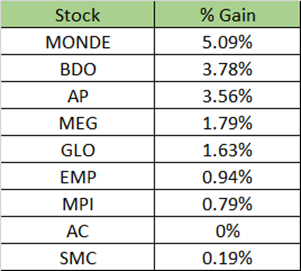

PSE market was led by the property sector with SM Properties (SMPH, 3.0%) and Ayala land Inc (ALI, 2.85%). For the blue chip index Alliance Global Incorporated (AGI, 3.61%) helped lift the market sentiment. While JGS (-1.63%) and BPI (-1.44%) led the index losers.

| GAINERS | % Gain | LOSERS | % Loss | |

| 1AGI | 3.61% | 1JGS | 1.63% | |

| 2BDO | 3.33% | 2BPI | 1.44% | |

| 3SMPH | 3.00% | 3GLO | 1.41% | |

| 4AC | 2.88% | 4WLCON | 0.55% | |

| 5ALI | 2.85% | 5LTG | 0.36% | |

| 6AEV | 2.82% | 6SMC | 0.19% | |

| 7GTCAP | 2.10% | |||

| 8MBT | 1.99% | |||

| 9CNVRG | 1.73% |

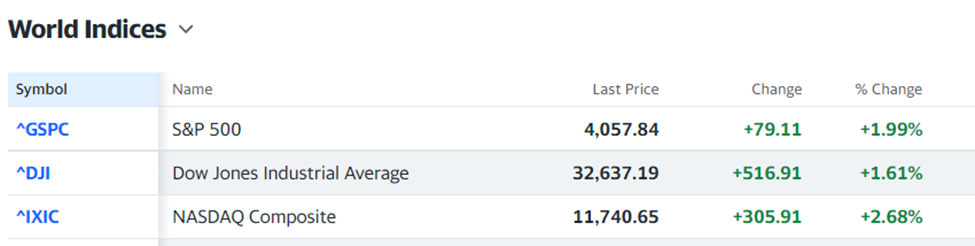

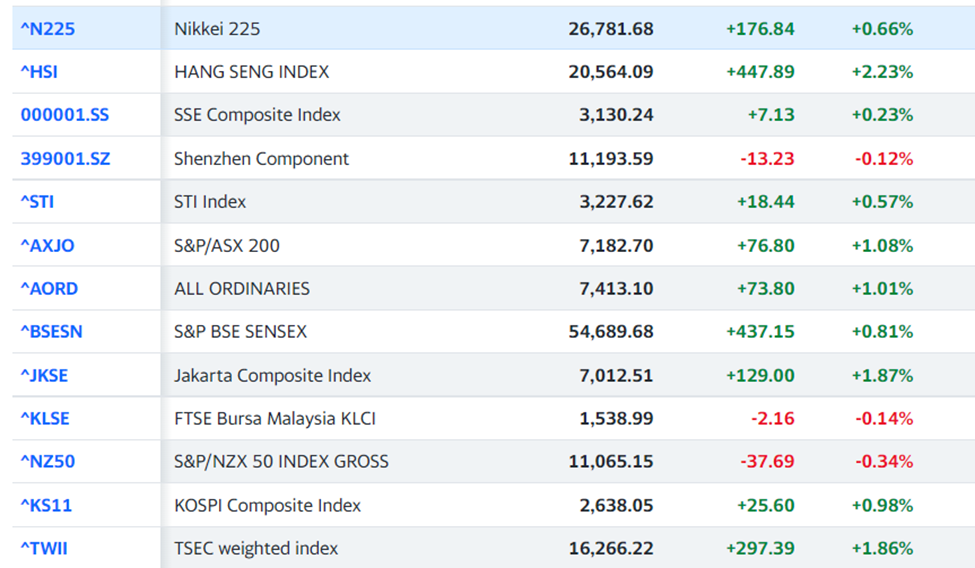

In the Global markets, US closed yesterday in high note as well with S&P 500 at 1.99%, Dow Jones at 1.61% and Nasdaq Composite index at 2.68%. ASIAN markets were higher today as well. The overall market sentiment is optimistic at the moment.