Table of Contents

First Half Results In

According to AREIT disclosure on PSE edge, the company recorded modest gains on the first half of the year. This is a a very good earnings despite the pandemic and occasional lockdowns that we are experiencing.

REIT companies offer the benefits of providing dividends from Rental income of its property portfolio.

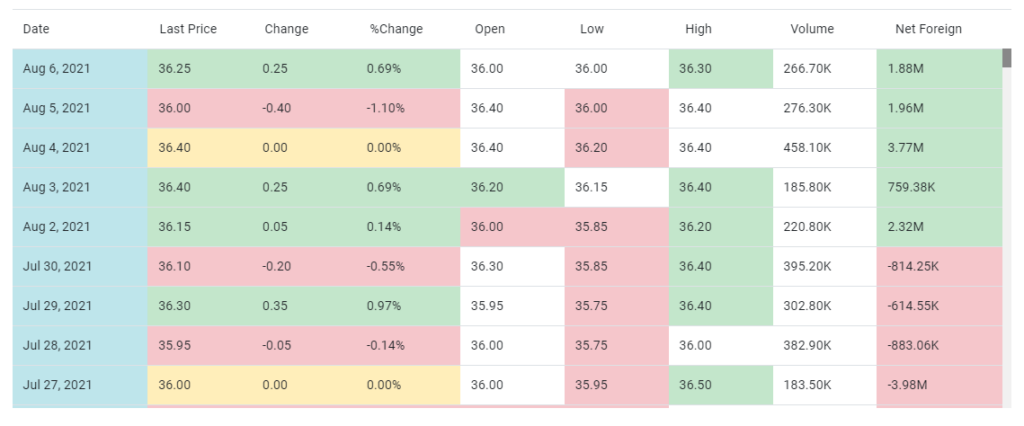

Last Friday closing the price of AREIT closed at 36.25pesos per share.

It stated;

“Ayala Land’s pioneering Real Estate Investment Trust (REIT) in the Philippines, AREIT Inc. (AREIT), posted revenues of P1.36 billion and earnings before interest, taxes, depreciation and amortization (EBITDA) of P1.05 billion for the first half of 2021, a 49% and 39% growth, respectively, versus last year. This is a result of the positive contribution of new properties, The 30th in Pasig, and land parcels in Laguna Technopark it acquired last January 2021, Teleperformance Cebu in October 2020, and rental escalations of existing leases. It sustained a high occupancy rate of 99%”

It has changed its accounting method from Cost Method to Fair Value Method

“To reflect the market value of its properties and align financial reporting practices with that of global REITs, AREIT secured the approval of the Bureau of Internal Revenue to change the accounting method it uses in valuing investment properties, from cost method to fair value method. The company received the approval last June which takes effect retroactively from January 1, 2021. Under the fair value method, it reported net income of P1.34 billion for the first half of 2021, 31% higher than last year.

Factoring out unrealized gains in the fair value recognition of its properties, AREIT’s net income reached P1.01 billion, 55% higher than last year, reflecting the company’s growth in earnings from its new properties and the stability of its existing buildings.”

Just recently AREIT and ALI and its subsidiaries, Westview Commercial Ventures Corp. and Glensworth Development, Inc., entered in a P15.5 billion property-for-share deal in June.

Disclosure states;

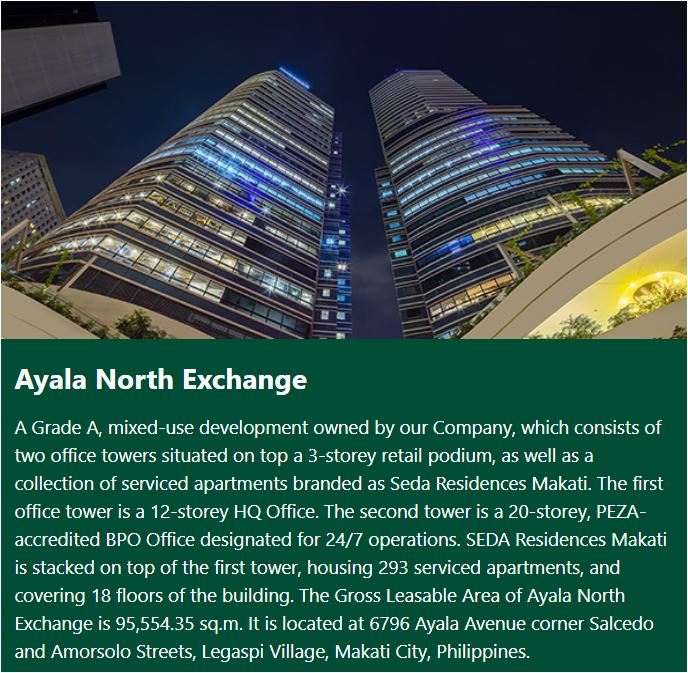

“Last June, AREIT and Ayala Land, Inc. (ALI) and its subsidiaries, Westview Commercial Ventures Corp. (WCVC) and Glensworth Development, Inc. (GDI), executed the Deed of Exchange on the property-for-share swap transaction. The share swap transaction is expected to be completed within the second half of the year. AREIT currently has six properties with a total gross leasable area (GLA) of 344 thousand sqm and assets under management (AUM) valued at P37 billion.

Its GLA is slated to grow to 549 thousand sqm and AUM to P52 billion with the said transaction of P15.5

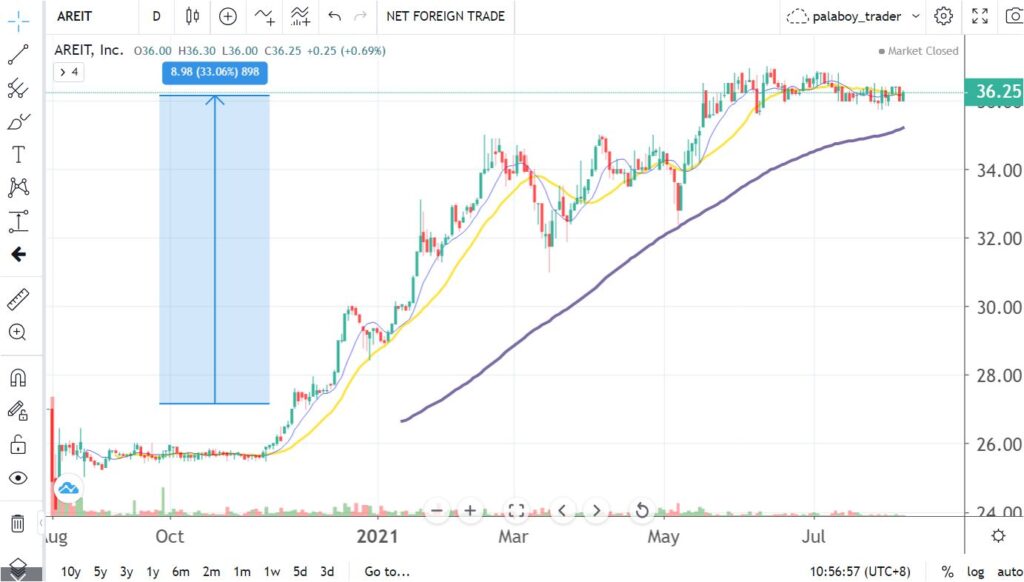

As of today, the stock price have significantly risen from its IPO price by more than 33%

There is also net foreign accumulation for the past few days