What is DOW JONES Industrial Index (DJIA)

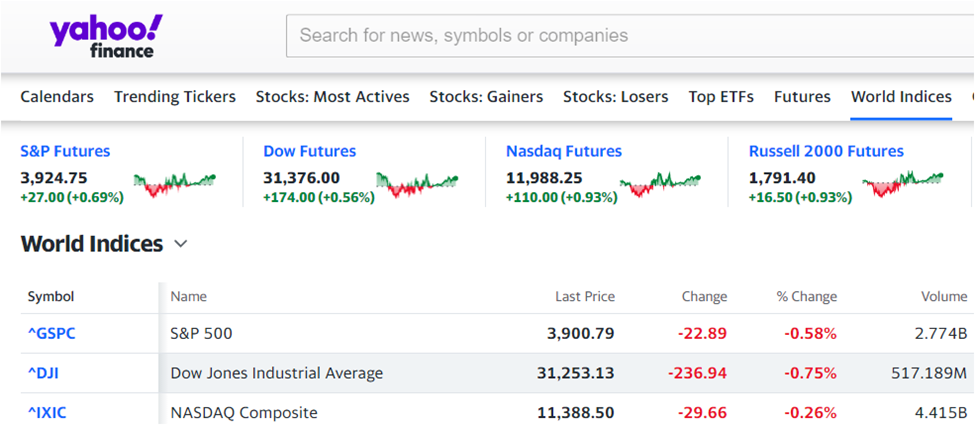

The Dow Jones Industrial Index is one of the three major indexes traders and investors monitor in the US Stock market. It is synonymous to our BLUE-CHIP Index List of the 30 Best companies. DJIA, or DOW 30 is consisting also of 30 Best companies or BLUE Chips in the US market. You can see the ticker symbol of this index together with S&P500 and Nasdaq Composite Index in Yahoo Finance section

What are the criteria to be included in DJIA

There are several measurements use to monitor the list of DJIA stocks and this is closely monitored by a group. Basically, it must comply to the following requirements;

1.0 Must be incorporated and headquartered in the US

2.0 Derive a plurality of revenues from the US

3.0 Help make the Dow representative of the overall US economy (less transportation and utilities)

4.0 Attract a large number of investors

5.0 Demonstrate sustained growth

6.0 Have an excellent reputation

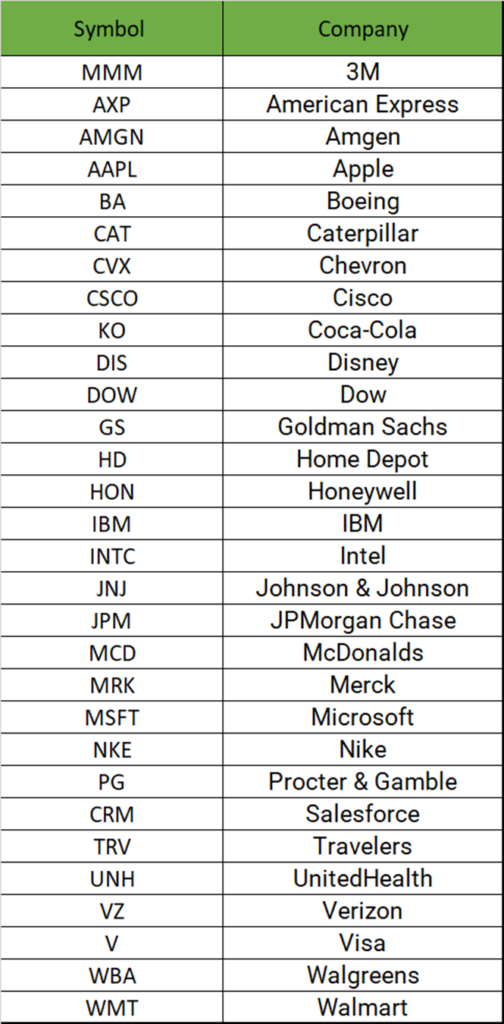

Dow Jones Industrial Index (DJIA) Stocks List

Here are the list of the stocks included in the DJIA index. Basically you can trade or invest only on each of the particular stocks listed, or you can track the index only which is a good representative of the average performance of this 30 Best Industrial related stocks in the US market

The 30 stocks which make up the Dow Jones Industrial Average or DJIA Index are: 3M, American Express, Amgen, Apple, Boeing, Caterpillar, Chevron, Cisco Systems, Coca-Cola, Disney, Dow, Goldman Sachs, Home Depot, Honeywell, IBM, Intel, Johnson & Johnson, JP Morgan Chase, McDonald’s, Merck, Microsoft, Nike, Procter & Gamble, Salesforce, Travelers, UnitedHealth, Visa, Walgreens, and Walmart.

The table below is for easier tracking of each of DJIA individual stocks

Can we invest in Dow Jones?

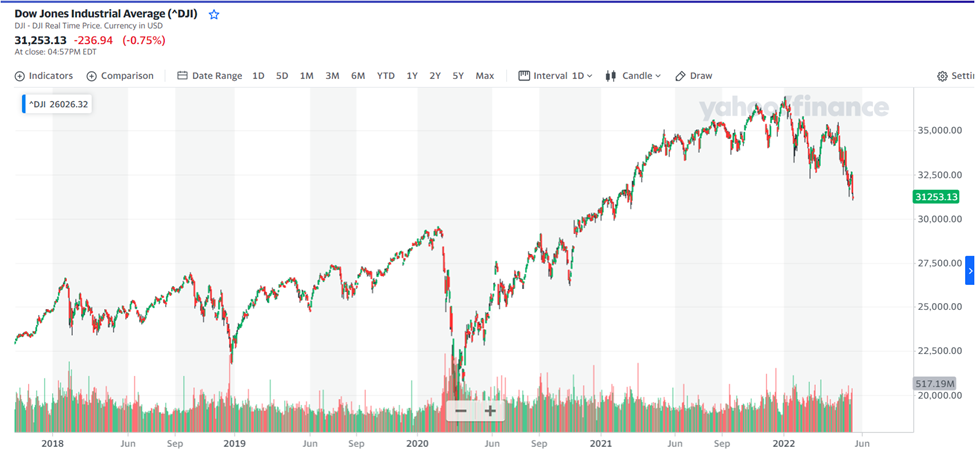

Yes, individual investors can invest on DJIA index. You can buy or sell DJIA with an ETF such as SPDR Dow Jones Industrial average ETF. Just like the Blue-chip index on PSE Market, this index provided good returns for the several years since it started operating. You can check the charting of the index. Provided you invested for the long term, it has yielded good returns since 2018 t0 2022

How to Invest in DJIA index?

There are several international brokerage companies providing ways on how to invest in DJIA, specifically, you can buy the shares of the DJIA through CFDs. Even Filipinos can invest in this index stock. You can do this buy opening an account in eTORO or XM Trading. I have a video for XM trading where instructions how to open an account is illustrated. You can check my video here.

You can open an XM trading account through this link: https://clicks.pipaffiliates.com/c?c=610128&l=en&p=1

How to Open XM Trading Account

How to Open eTORO account

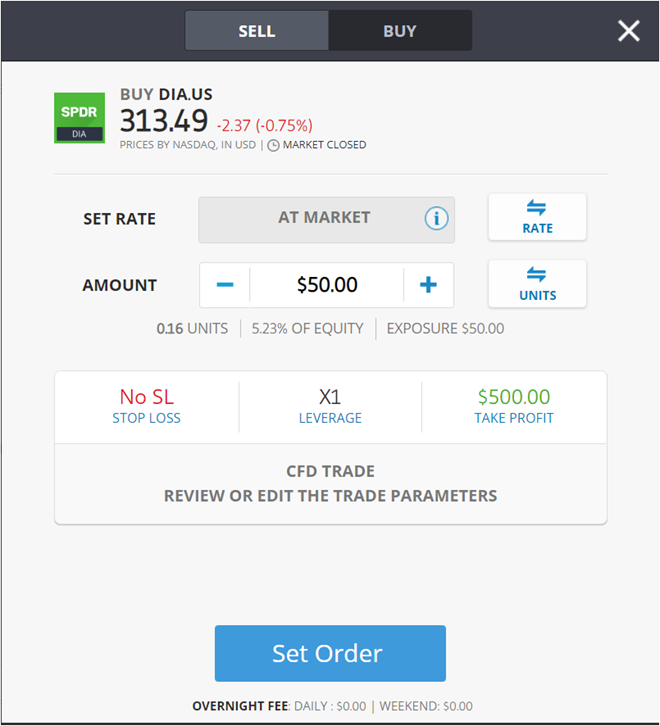

For eToro, you need to open an account as well and select DIA US which is the SPDR Dow Jones Industrial Average ETF Trust.

Here is a sample video on how to open an eTORO account.

Once you have funded your account, click the “TRADE” button, enter the amount you want to invest and determine whether you are shorting or buying long the Index stock. Leverage is normally set to X1 only to avoid too much risk on investment.

Remember to put your Stop loss and Take profit areas. Always manage your risk and invest amount you can afford to lose especially if you are just starting out If you intend to stay long, you can do a long term cost averaging strategy as I have posted on this link for Long Term Investment strategy.