Table of Contents

Last Updated on: October 15, 2022

This topic covers the way how we do long term investment in the stock market.

You must already know that to be able to grow our assets or money, it needs to be invested and one of the ways is through the stock market. We have a previous article where we try to understand why do we need to invest, you can check the link and find out why it is necessary especially during this pandemic period.

3 reasons why do we need to invest

- We need to be financially prepared. For regular employees like us, we need to secure our future and be ready whenever the time comes that we are no longer able to support our family or ourselves. Being an employee will serve the purpose of our income source but due to uncertainties we could not rely on a single sour

2. Inflation cuts our spending power. Every year the price of commodities keep on increasing and this is know as inflation. In the Philippines inflation takes an average of 3-5%. This means that our spending power becomes less by this value as prices of basic needs go up.

Philippines is in the map region where we are always visited by typhoons. Every time it comes, the production rate of say for example agricultural products becomes affected so the supply becomes scarce due to flooding or too much rains exposures our farm lands could not bring the necessary amount of products.

As a result of fewer products in the market, with population always growing in numbers, demands become higher and causes price of products to shoot up.

3. Savings does not add value to our money. Money in itself does not produce more money. If you put it in a bank, it does earn interest but at values of less than 1% in a year and this would not help do much to beat the inflation effects.

So if we want to earn from money we need to put it in an investment, or as they say let our money work for us

Short Term or Long Term Investment in the Stock Market

There are different ways of doing investing in the market. You can do it in the short term or long term. Although there is an argument to which of these two will be more beneficial it will still depend on the individual skills.

Short term investors also known as traders will tend to speculate on the market movement in the short term. By analyzing price action movement, skilled traders can benefit in the short term especially those who have time to monitor the markets.

Short term investors however are more affected by market volatility and since they are more sensitive to news or activities on a certain company or stock, trading will often lead to more stressful way of investing in the market. As they say 95% of traders loose money while only the remaining 5% are earnings from trading.

As a long time short term trader of the market, I know personally that this is true. But there are perks to short term trading that you can not find in long term investment. For example, if you only have a limited capital to invest, then trading for small gains is the best option to do. Trading can be high rewarding but will definitely have risk. Traders have the advantage of easily going in and out of a certain stocks to ride only the market volatility. With the right discipline as well you can weather out the negativity on the market, for example if you are able to get out during the 2020 national lockdown, you can take advantage of the reversal that happen for that year. It can give good results if you are patient in the market

Long term investors in the long run will benefit from accumulation of shares of a company over time. As a certain company grows so its price value as well. But during this growth stage you can be certain that prices will fluctuate significantly above or below your average price. To eliminate the volatility risk, long term investors buy only shares of stocks on regular intervals.

I have listed below some of other reasons of being invested for the long term in the market.

6 Advantages of Long term Investment

- The market moves up in the long term

- You can sleep better at night

- You will save on commission charges

- Weather out the market volatility

- It takes advantage on the effect of money compounding

- You will maximize benefits from fundamentally good stocks like dividends

The market moves up in the long term. If you will try to look at the Philippine stock exchange index you will notice that it keeps going up year over year or as the time becomes longer, the value of the index is increasing. The the index going up it means that the share prices of stocks especially those that have been in the market in the long term have grown significantly already.

So there is a big chance that if you stay long enough, the overall market movement is always going up.

You can sleep better at night. This is true, short term traders tend to be more stressful because they spent too much time speculating whether the price of the stock will go up or down in the short term. If you widen your timeline, there is no need to hurry for the gains from you investments.

You will save on commission charges. Everytime you do transaction of buying or selling in the market, your stock broker is charging you 1.19%. Ten time buying or selling is equivalent to 11.9%, quite big right?The value maybe small but if repeated many times, it will tend to accumulate. Buying at different times with a longer time frame perspective will diminish the effect of your broker charges

Weather out the market volatility. If you look at day chart candles of Banco De Oro, you can notice that price seems to move always either upwards on downwards, but if you view it in the month timeframe, you will be able to see the macro view of the price movements.

Day chart

Monthly chart

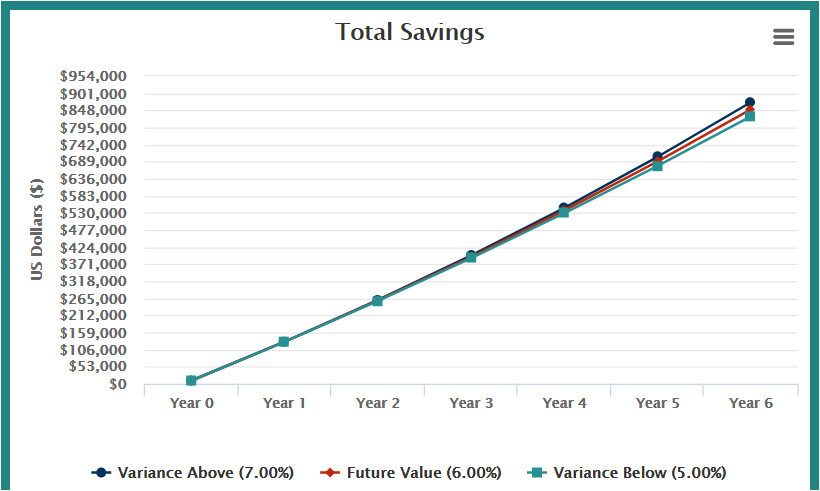

It takes advantage on the effect of money compounding. As an example if you invested 10,000 at the start and keep it every month with a 6% annual interest for 6 years you will have later 851,000 in total amount. Very big effect of compounding.

You will maximize benefits from fundamentally good stocks like dividends. Stocks giving out regular dividends are good to keep because aside from the prize appreciation, you can receive extra money from the company. You can check our article, dividends in the stock market to learn more about how to do it

How to do the Long Term Investment?

So here we have an example of how to do a long term investment in the stock market. Take note of the reasons for buying and then why we keep on buying and doing it at regular intervals of time

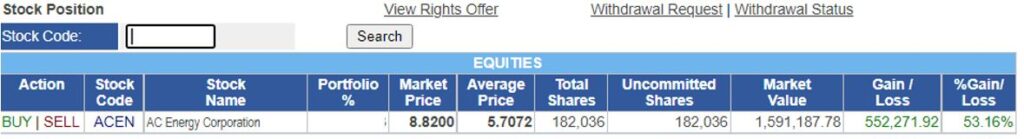

Example of long term investment on an actual stock (ACEN, AC Energy Corporation)

Long term investing is what is also known popularly as Peso Cost Averaging method of investing in the market. It is a type of investing where you buy regularly in a good stock or company in definite intervals.

You can do this weekly, monthly or every quarter depending on your capital availability to meet regular timeframe of investing.

Long term investing is also for those who does not have time to actively monitor the market especially those who have work during the trading periods. Take note that when you do investing in the market, make sure that the money you are using is not for emergency use. You must keep invested to weather out volatility of the market. The length of time depends on individual goals, it could be few years to a decade. The long it is the better if the stock price keep on appreciating.

This is also most suitable for those who are just starting out to test the markets. Trading in the short term as mention involves high volatility and risk exposure especially if you are doing it in companies that are not sound fundamental.

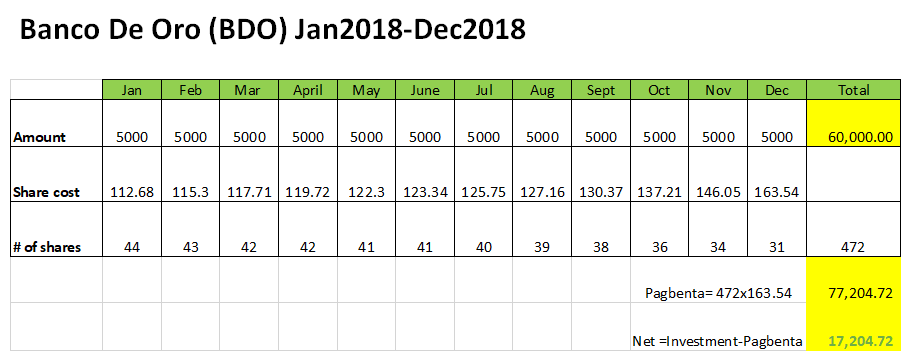

From the attachment above, we have an example of Banco De Oro. If you started investing on this stock from January of a certain date period to December of the same year a 5,000 pesos investment at the start will have been able to have accumulated a total of 60,000 pesos. But since the price appreciated during that time frame of accumulation, the total amount actually gotten from it would be 77,204.72.

Every month we could accumulate different amount of shares as the price keep on moving. For example at January my 5k pesos can buy 44 shares while in February only 43 shares. There are times the price move up significantly like in August to December so the number of shares we can buy will be lower.

In the end we accumulated 472 shares by December, if the share price is 163.54 during this time and you decided to sell, just multiply shares total by the price that you will sell it, for this case total is 472 shares x 163.54=77,204.72

There are times however that you cannot maintain the 5000 pesos per month, its ok just keep invested any amount because in the end, the more shares you accumulated and if the share price goes up so is your gain in the market.

The two blue arrows on the graph represents the time frame January to December for our example. But looking back at history of Banco De oro, if we could have only started it sooner, the share price of 60pesos/share (green arrow) we have already increased to 160/share or a total percentage of 167%.

2 Main Criteria for staying Long term in a Stock

- Consider only stocks that below to the Blue chips index. These stocks have been carefully selected by the Philippine stock exchange so they are the the best of the crop. The list is updated at least once a year so be sure to research them well. As of this time the blue chip list link is here so you can check it out. Blue chip stocks offers liquidity and this is where majority of investors are also invested. Also since it has large base of capital and already proven track record, the chance that it will go bust is very small as compared to penny or low cost stocks.

- The stock should be in uptrend direction. In Philippine stock market setting, we can only have profits with our investments if the overall stock movement is in uptrend direction.

Watch our Video Explanation here

Related Articles:

How Do you Earn From the Stock Market by Price Appreciation

How to Earn from Dividend Stocks, List of PSE Stock Dividends for September 2022

Why We Need to Diversify Our Investments

Keep Grinding guys