The PSE index rebounded by as much as 2.35% for the day. Majority of the stocks rebounded after a heavy selling the other day. A bullish engulfing candle can be seen.

Blue chip stocks are mostly in green today.

1ICT5.78%

2ALI4.15%

3SMPH4.14%

4BDO4.01%

5JGS3.97%

6MEG3.45%

7RLC3.05%

8AC2.78%

9PGOLD2.65%

10DMC2.53%

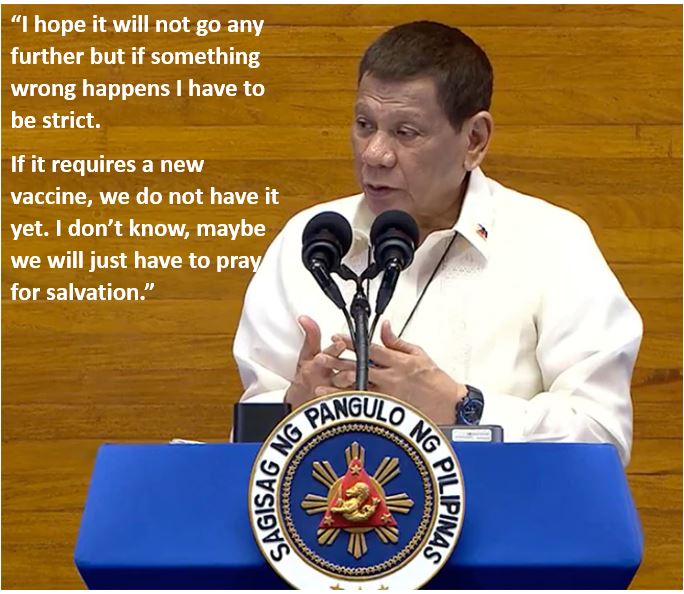

The president in his last year in the office SONA completed delivering his speech yesterday. Among his accomplishments, include Universal Health care, Freedom information bill and Free Tuition fee in college and universities.

He also included that his government is able to settle the long time issue for the “Coco” levy fund by the late president Marcos. According to him the coconut levy fund was return to its rightful owners which are the farmers.

With regards to the lockdowns, he stressed out that we may imposed stricter protocols if the need for it arise. He mentioned that we need to have proper health system management as we cannot afford extension of these lockdowns as it may have irreparable effect on the economy

“It seems that it is really dangerous, we really have to go back to a lockdown,”

“I hope it will not go any further but if something wrong happens I have to be strict. If it requires a new vaccine, we do not have it yet. I don’t know, maybe we will just have to pray for salvation.”

On the economic side of the SONA, the president emphasize the need to pass legislation to amend the Foreign Investments Act, the Retail Trade Liberalization Act, and the Public Service Act.

He urged the the congress in passing the bill and considering it as urgent.

“I would like to renew my call to Congress to immediately pass the amendments of priority legislative measures such as the Foreign Investments Act, the Public Service Act, and the Retail Liberalization Act,”

In addition he pointed out that “The Retail Trade Liberalization Act, when you go to the mall, you have options. If we have more open trade in the retail sector, then the ordinary Filipinos (when) they go to shop, they have more options. When you have more options, the prices fall, the quality increases,”

The economic reform bills are also targeted to be passed by October this year.

There is a net foreign selling of -329Million