Oct 22,2021

High credit rating for $CHIB.CHIB received an issuer rating of PRS Aaa from Philippine Rating Services Corporation (PhilRatings) with a Stable Outlook.

$MWIDE named Most Innovative Company: MWIDE won the United Neon’s Most Innovative Company of the Year during the 12th Asia CEO Awards virtual ceremony held last October 12, 2021.

$GLO unit launches FINSI. GLO’s fully-owned Asticom Technology launched Fiber Infrastructure & Network Services (FINSI) to help telco firms speed-up thier fiber rollouts. The new unit would provide end-to-end services & industry-specific solutions to telco

Oct 22,2021

STOCK IN FOCUS

$PSE:BDO , $PSE:ACEX , $PSE:MPI

BDO closed at P126.40. We expect the stock to test the support zones near P123.30 and P120.00, we recommend taking this oppurtunity to accumulate shares near near the support zones with a medium-term target of P142.20 and P160.00, place a strict mental stop if the stock closes below P114.00

The Peso moved sideways against the Dollar on Thursday as market participants awaits the release of the latest budget balance data. The Peso closed at P50.81 per dollar on Thursday, shedding two centavos from its P50.79 finish on Wednesday.

Oct 22,2021

First Metro Sec

$BSC: Eyes to become a full energy company following its plan to acquire 60% of independent oil firm FilOil Energy Co. Inc.

$PAL: Is calling for the removal of quarantine stays in an accredited hotel or other designated facilities for fully vaccinated passengers arriving from North America.

Eco: BSP Gov. Benjamin Diokno said interest rate hikes are unlikely this year as inflation remains manageable.

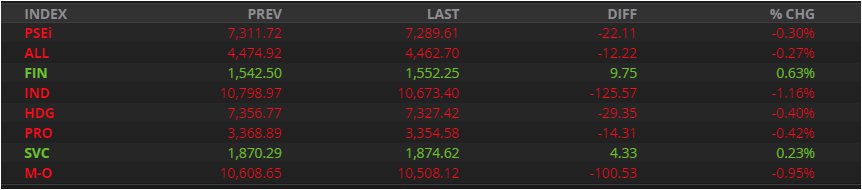

PSEi closes at 7,289.61 down by 22.11 pts (-0.30%)24

$FMETF : Closed @ 110.80 iNav @ Php110.6937 vs last NAV @ 111.00.

$FRUIT (+2.24%): Disclosed that it has achieved the target of 100 community stores 71 days ahead of schedule and reopens 90% of its store network.

Oct 22,2021

$SCC President/COO Buys More Shares

$AC Ayala commits to achieve net zero by 2050

$DMC Director/Assistant Treasurer Buys More Shares

$DMC Chariman/President Buys More Shares

$DMC Director Buys More Shares

$DMC Substantial Shareholder Buys More Shares

$MBT Metrobank hailed the Strongest Bank in the Philippines

$DNL D&L’s export revenues have already overtaken imported costs, provides natural hedge against continued peso weakness