What is 2tradeAsia?

Incorporated in early 2000, 2TradeAsia is a pioneer in online stock trading with a mission to develop an innovative and efficient online investment solution in the country. 2TradeAsia is one of the leading stock brokerage in Philippines today.

Why do we need to know how to Invest?

There are different ways to earn extra income from the stock market either through stock investing where you can earn from price appreciation or through stock dividends.

Though, Yes we can save money into our job/work but here’s the question? Do you just want to save money for long period of time without getting any extra passive income. But what if I say that your savings can grow more, said by the quote “Let your money, work for you” In 2TradeAsia you can simply invest your money with assurance that it will grow every time if you know how 2TradeAsia works.

Benefits of 2tradeAsia

–Accessible for everyone

In here all of us are free to use 2TradeAsia, we can also simply download it on Mobile App and use it every where we go we can buy stocks/shares every time.

-Yields Higher Interest

When investing our money to bank it has it’s limitation. But by putting our investments to a stock market in general you have the control whether how much your capital and your income as well.

-Money At Work

The word itself “Money at Work” your money is working for you. It is a passive income

-Safe and Secured

We have the assurance that our money is safe because this is well-managed company. In stock market you have the rights, fairness at the market is transparent to their investors.

-Easy Transactions

You can easily withdraw your money using your online stock broker within 3 days or more.

STEP BY STEP PROCEDURE ON HOW TO CREATE ACCOUNT WITH 2TradeAsia

- a) Sign up to this link by click it https://www.2tradeasia.com/ and click the “Open Account” below. You can also access it through mobile app on Google Plays store (For Android Users) and App store (For IOS Users)

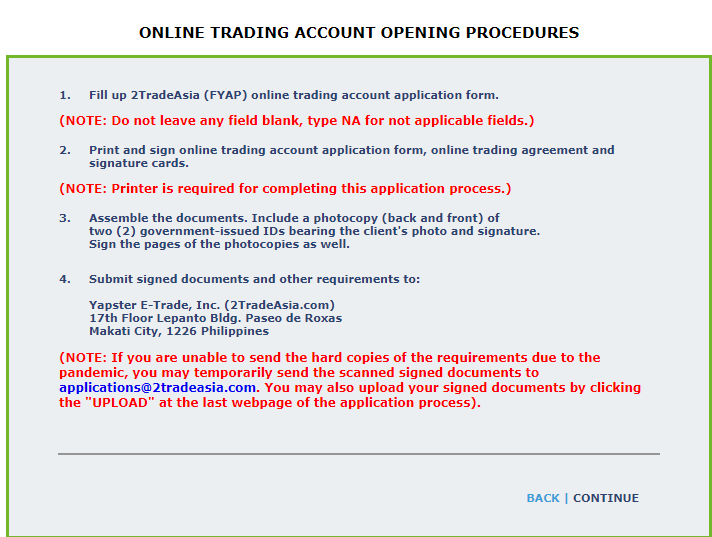

- b.) Then you will see the information below “Online Trading Account Opening Procedures” read the instructions carefully to avoid misinformation. Then After that Click “Continue”. Just a gentle reminder at this stage, take note that before submitting the filled up form, make sure to double check any details

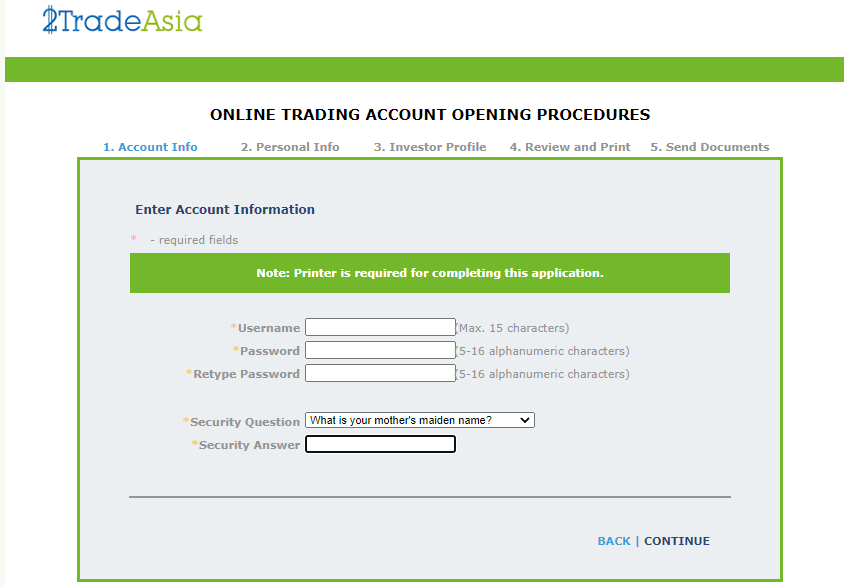

Step 1: Fill up the following Account Information such as Username, Password, Security Question/Answer then proceed by clicking “Continue”

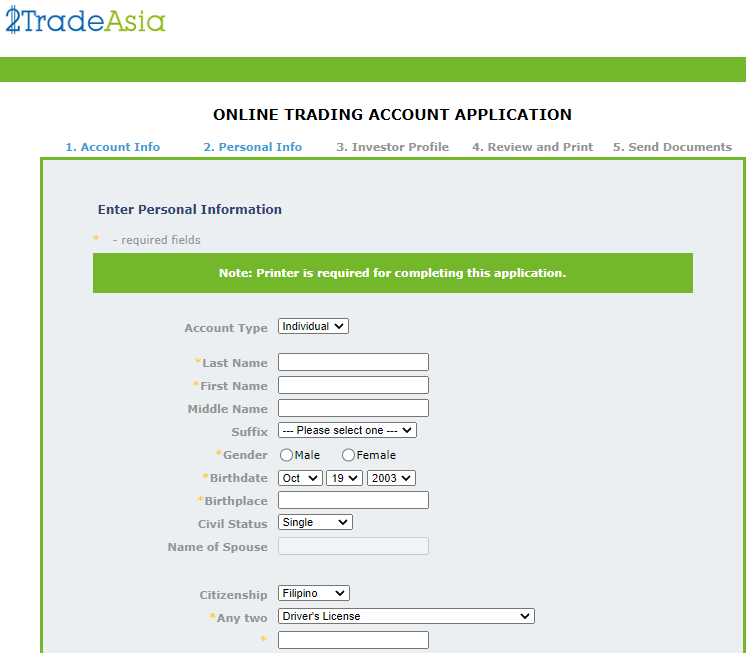

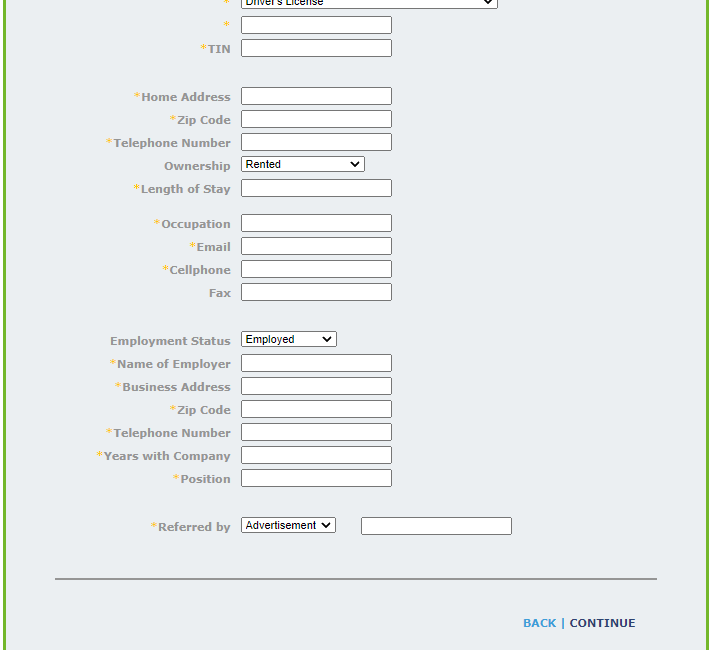

4.) Step 2: Just Repeat and Answer the following Information accurately.

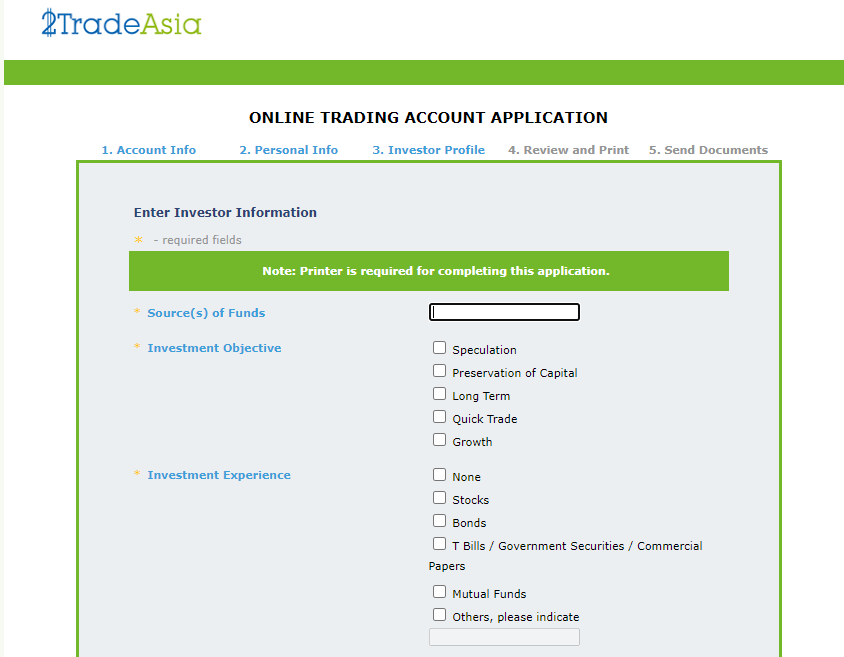

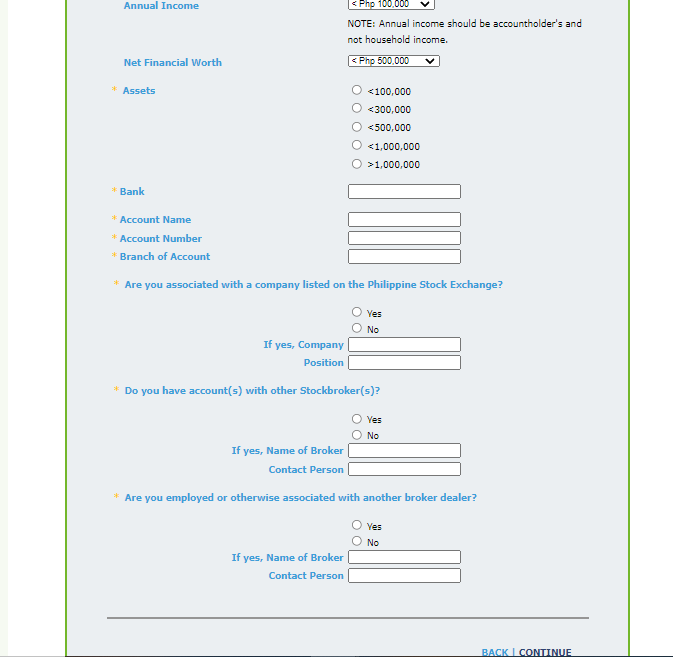

Step 3: Next one is “Investor Profile” in here they need to know what type is your work and your capital income per month. So I suggest answer it honestly. Then Afterwards click “Continue”

Step 4: In here you will “Print and Review” your personal information make sure that all of them are accurate. Before you click “Continue”

Step 5: “Sending Document” you need to put an address and to attach at least 2 Valid ID’s to proceed.

Step 6: Wait for the “Activation Email” that is going send through your preferred email address.