The inflation data released by the US yesterday is 8.3% higher by 0.1% month over month resulted to a panic selling in the stock market, the worst sell off in the market since 2020.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and

services. The CPI reflects spending patterns for each of two population groups all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 93 percent of the total US population.

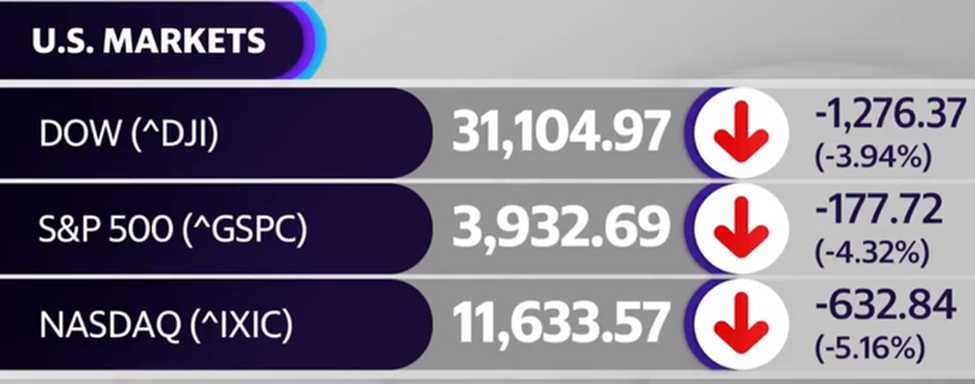

All US indices tumbled and drop significantly last night.

| Symbol | Name | Last Price | Change | % Change |

| ^GSPC | S&P 500 | 3,932.69 | -177.72 | -4.32% |

| ^DJI | Dow 30 | 31,104.97 | -1,276.33 | -3.94% |

| ^IXIC | Nasdaq | 11,633.57 | -632.83 | -5.16% |

The market is expecting a faster take up by the feds to raise interest rates. As we know the high CPI value release today is very persistent and investors are worried that it will cause sudden spikes in prices for basic commodities.

Tech stocks, retailers and banks were among the worst hit where the market eked out all gains from the past four days of rally.

Wall street also is quite worried that we may be in fact heading to a recession.

The last four days rally signified a confidence last time by the market that the inflation is already in control, but the results is showing otherwise.

VIX or volatility index which is a “fear” gauge for the market managed to go up by as much as 8% today. This index moves opposite to what the market is doing.

We are expecting the local markets to follow the US move.