Figaro Coffee yesterday disclosed its consolidated annual audited financial earnings to be up by 111%.

The company delivered a top-line sales number of P2.43 billion, an increase of 80% from the same period last year, and a net income result of P198.2 million, an increase of 111% from the same period last year, driven by continuous strong store growth.

Through economies of scale and cost synergies, the company increased its gross margins from 44% to 49%. It increased operating income by 64% as a result, and it displayed a 13.5% return on equity.

They also announced its first dividend to be P0.01936 per share as of November 21, 2022 record date. Total amount allocated is 90 million pesos.

“We are very pleased to report that coming out of the pandemic and our initial public offering early this year, we have continued our excellent growth and positive momentum.

We are seeing dine-in sales increasing on our Figaro Coffee and Tien Ma’s brands while delivery continues to be strong for Angel’s Pizza. We continue to focus on product quality, value-for-money and expansion in key areas in the Philippines.

We acknowledge that there are always new and pressing challenges such as inflation and economic headwinds, but our team continues to find the best ways to optimize growth and manage costs for the good of the company.

Likewise, because of our excellent performance, we are very happy to be able to share profits with our shareholders through dividends. Our philosophy is, if the company does well, we would like our shareholders to benefit also,” said Justin Liu, Chairman of FCG.

Since its IPO the company already added 35 stores with a goal of 163 by the end of 2022 from 107 stores last December 2021.

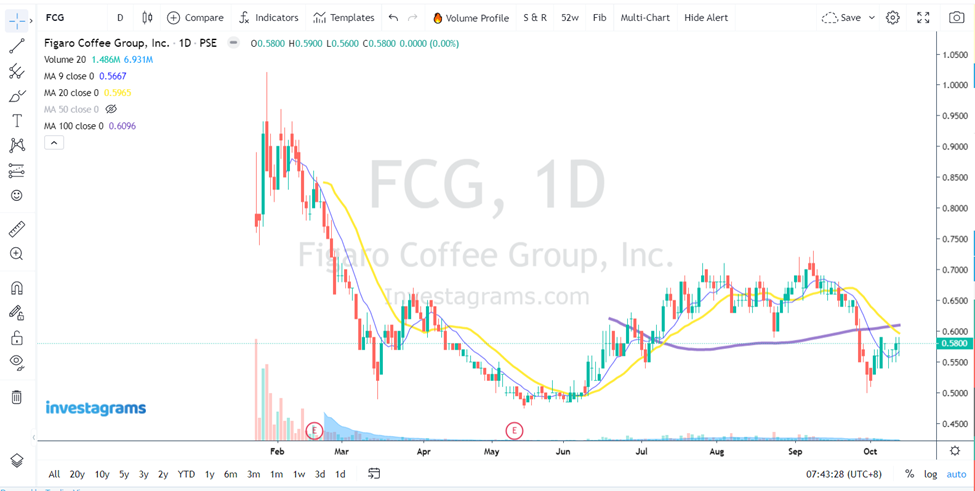

FCG share prices were flat for yesterdays trading and close at 0.58 pesos per share.