The PSE sighed a relief bounce for today as it moved up in unison with global stocks. The US Feds have finally unveiled their plan to increase interest rates to fight the rising inflation of 8.6%. Markets have been rattled down very fast starting last week when the news about high inflation started.

US Feds increase the interest rates by 0.75%. Short-term borrowing costs are now in a target range between 1.50% and 1.75%.

There is also the threat coming from Alert level tightening in the Philippines if the COVID cases spikes again. There were instances of increase in positivity rate in National capital region and OCTA research group predicted an upsurge in cases for NCR.

The index closed at 6,393.01 but still reeling from a net foreign selling of -295.08 Million. No foreign support as of the moment.

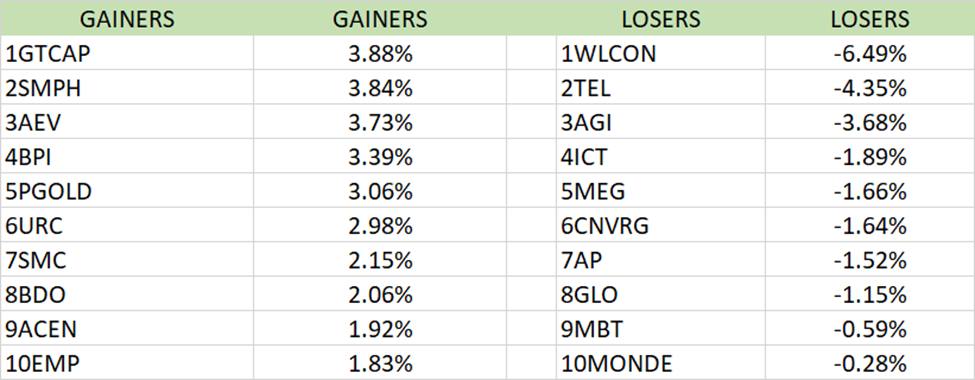

For the sector category Property led the market by 2.37% and decliners were Service sector which is down by -2.05%.

For the BLUE chip Index top gainer is GTCAP at 3.88% and SMPH at 3.84%, while losers was led by WLCON (-6.94%) and TEL (-4.35%).

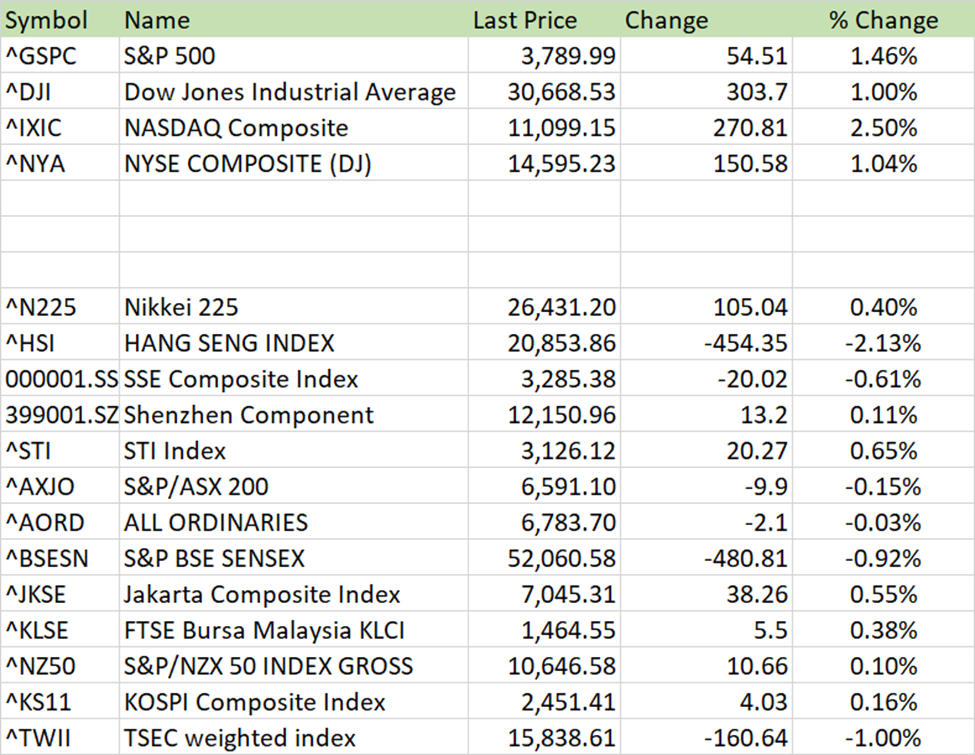

US Markets movement yesterday spark the rally for ASIAN Markets. S&P500 move up by 1.46%, Dow Jones up by 1.0% and Nasdaq Composite up by 2.5%.