PSE market corrected after 5 days of consecutive gains as it ended the week in red with a -0.3% drop. This could have been brought by profit taking after most of the stocks have move up significantly for the week. 7 day average of Covid cases continue to drop and consistent supply of vaccines have fueled the previous index run. There are also news surfacing that a subvariant of Delta variant virus which is more contagious than the existing Delta variant have been detected in Europe.

The index close at 7,289.6 just below the 7.3K resistance level with a net foreign selling of -17.86Million.

For the PSE market Blue chip index, highest gain for the day was SECB (2.87%) while loser is from ACEN (-3.38%) and JFC (-2.51%).

| GAINERS | LOSERS |

| 1SECB2.87% | 1ACEN-3.83% |

| 2BLOOM2.00% | 2JFC-2.51% |

| 3WLCON1.43% | 3LTG-2.11% |

| 4GLO1.27% | 4AGI-2.00% |

| 5BDO1.27% | 5AEV-1.72% |

| 6RRHI1.00% | 6ALI-1.70% |

| 7JGS0.99% | 7GTCAP-1.40% |

| 8PGOLD0.74% | 8MBT-1.00% |

| 9SMPH0.41% | 9MPI-0.96% |

| 10MEG0.32% | 10TEL-0.80% |

| 11SMC0.17% | 11URC-0.71% |

| 12AP0.16% | 12MER-0.67% |

| 13BPI0.12% | 13AC-0.46% |

| 14SM-0.39% | |

| 15CNVRG-0.32% | |

| 16RLC-0.12% |

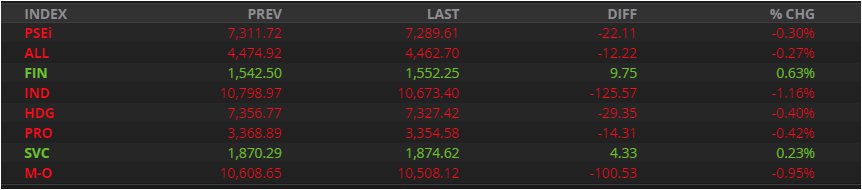

For the index sector, finance is the leader after most of the banks recovered from the previous corrections. Industrial sector of the market suffered highest (-1.16%) correction for today.