(Last Updated On: )

The PSE index rallied by as much as 2% for the day and ended the market in green. It closed by +0.9% much lower than its peak movement. Only 8 stocks from the Blue chips index were in the red.

The oversold condition of the market since last week presented an opportunity for bargain hunters to pick up blue chip stocks.

Bullish Sentiment from the World Bank

The Washington-based World bank lender increased the gross domestic product (GDP) projection for the Philippines from the 5.7% stated in April to 6.5% in its East Asia and the Pacific Economic Update report for October, which was published on Tuesday. This is below the government’s target range of 6.5-7.5% for this year.

On its press release World bank stated “Primary deficits have, on average, resulted in a 1.1 percentage point increase in the public debt-to-GDP ratio. It would be difficult to cope with high debt to GDP using fiscal consolidation as a policy option, according to historical patterns seen in the majority of East Asia Pacific countries”

The market ended at 5,934 index level with a net foreign selling of -495 Million. It did bounce today but our foreigner support is still not there.

For the Blue chip index, SM (+3.68%), ACEN (3.45%) and JGS (3.29%) led the gainers while the lossers were led by CNVRG (-4.97%), ICT (-3.97%) and AGI (-2.07%)

GAINERS

1SM 3.68%

2ACEN 3.45%

3JGS 3.29%

4AEV 3.08%

5RLC 3.00%

6MPI 2.99%

7BDO 2.61%

8JFC 2.45%

9PGOLD 2.43%

10MEG 2.43%

11TEL 1.89%

12SCC 1.81%

13LTG 1.46%

14URC 1.17%

LOSERS

1CNVRG -4.97%

2ICT -3.97%

3AGI -2.07%

4EMI -1.32%

5GLO -1.23%

6SMPH -0.62%

7AC -0.46%

8BPI -0.33%

As for the ASIAN markets, majority of the Indices rebounded as well taking a cue from the strong bounce of the US markets.

| Symbol | Name | Last Price | Change | % Change |

| ^HSI | HANG SENG INDEX | 17,143.27 | -107.61 | -0.62% |

| 000001.SS | SSE Composite Index | 3,041.14 | -3.93 | -0.13% |

| 399001.SZ | Shenzhen Index | 10,918.41 | 18.72 | 0.17% |

| ^STI | STI Index | 3,135.69 | 19.38 | 0.62% |

| ^AXJO | S&P/ASX 200 | 6,555.00 | 93 | 1.44% |

| ^AORD | ALL ORDINARIES | 6,760.60 | 100.8 | 1.51% |

| ^BSESN | S&P BSE SENSEX | 56,718.65 | 120.37 | 0.21% |

| ^JKSE | Jakarta Composite Index | 7,060.82 | -16.21 | -0.23% |

| ^KLSE | FTSE Bursa Malaysia KLCI | 1,401.76 | -0.13 | -0.01% |

| ^NZ50 | S&P/NZX 50 INDEX GROSS | 11,200.04 | 80.47 | 0.72% |

| ^KS11 | KOSPI Composite Index | 2,170.93 | 1.64 | 0.08% |

| ^TWII | TSEC weighted index | 13,534.26 | 68.19 | 0.51% |

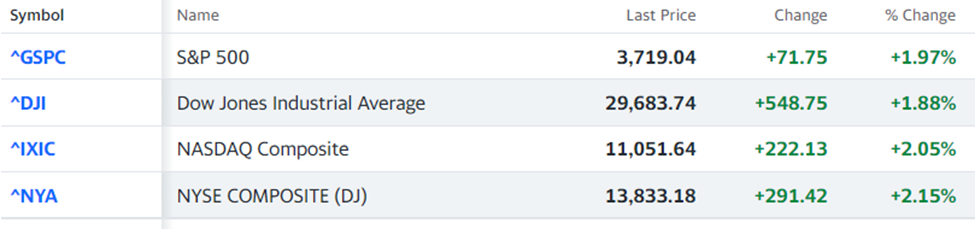

US stocks closed the market with a strong technical move with Dow Jones closing by +1.88%, S&P500 up move of +1.97% and Nasdaq index moving by +2.15%

US Indices futures are pointing to a bearish Thursday trading.