Last Updated on: July 30, 2021

Investing is commonly heard when we talk about life progress. We always hear this from resource speakers, financial advisors and mentors.

For most Filipinos there are two ways of making money that is by working or by having a business. Most will surely agree that working is more sustainable to do because to start a business your need some capital and because of our certain obligations be it our house payments, growing children, providing for our parents.

We are also risk averse as business history in our country shows that only a handful become successful in the long run.

But if you are thinking about it carefully, having to work or getting a job will serve its purpose as long as we still can do it at the best of our abilities. I always come to think of it especially having to work for the last 10 years and as an OFW in Malaysia. I can still do it so my boss is still re-hiring me, but by the time I can’t bring results, as you know OFW’s are contract based, anytime they can cancel my contract and let me go. Even if we can sustain it long enough, a time will come that we have to let it go and retire without a source of income.

Later on, if we don’t work, how are we going to sustain our obligations? Who doesn’t want to live what we want to do later either your passions in life or travelling when it is allowed again? Then the concept of investing comes to our mind.

Investing is a pre-requisite to ensuring your future financial security. By investing you are not only adding savings for yourself but also you end up having another source of income. Passive income can come from different forms or sources and one of this that we focus on this site is from passive incomes sources like the stock market. In the stock market you can earn from price appreciation (when the price of the stock that you buy goes up) or through dividend payments from good companies

Investing is using your money to make more money as the say in layman’s term. We are working to make money so it is wise also to make money work for us.

And just like any other business however, as I always mentioned in my vlog’s on my youtube channel “Palaboy Trader” there is a risk in investing especially if you don’t know the nature of what you are going into. Investing in the market is very lucrative if you follow a certain discipline and you can avoid taking big risks or end up losing what you work hard for

Is Saving similar to Investing?

Savings is the result of having to take from a surplus of your income and it does not generate additional source of income rather it serves as our buffer for emergency use. It does not add value when you just keep your money at the bank (well with a small interest rate it does give a few percentage, but is not enough to be considered significant).

Here are the list of things or ideas I can identify why we need to start and keep on investing even if we are currently at Pandemic stage

1. Financial Freedom

This is the simplest reason why do we need to invest, that is to achieve financial freedom. To have financial freedom means having enough cash to sustain our families and ourselves.

As I mentioned, we have certain obligations we are trying to fulfill that is why we still cannot leave our work. Majority of us who are working have the dream of having our own house so we have monthly loans we need to pay. For others who are preparing for our children college goals, tuition fees are always to be considered and as mentioned during our retirement we need to prepare that there will come a time that we will not be able to have full time jobs.

Since most of us have only one source of income, we should set our goal and learn ways on how to be able to manage these current obligations and on the other hand prepare for investment as keeping our savings on the banks with low interest rates would not be enough, the investment is therefore needed to create wealth as time goes by.

You need to take charge of these things and keep a clear perspective of what needs to be done to accomplished your life’s long goal of becoming financial independent.

This website purpose is to be able to guide those who are willing to take the opportunity being given by the market. As investing in stocks or for dividends involve very little capital only. To build your wealth correctly for your future requirements you need to study the market properly and work towards the same.

I have and am currently guiding people on the proper way of investing in the markets to minimize the risk, you can check my membership section if you are seeking for guidance.

2. Inflation

Due to the current pandemic situation, prices of goods are fluctuating very fast and your ability to buy these products goes in opposite direction as you can only buy now fewer worth of items when the price gets high. Such is the nature of inflation.

Here in the Philippines, our inflation is quite high and it grows annually up to 4-5%

This means our purchasing power is reduce by the same amount every year. You can tell this easily when you look at the prices of your favorite products when you are young as compared now

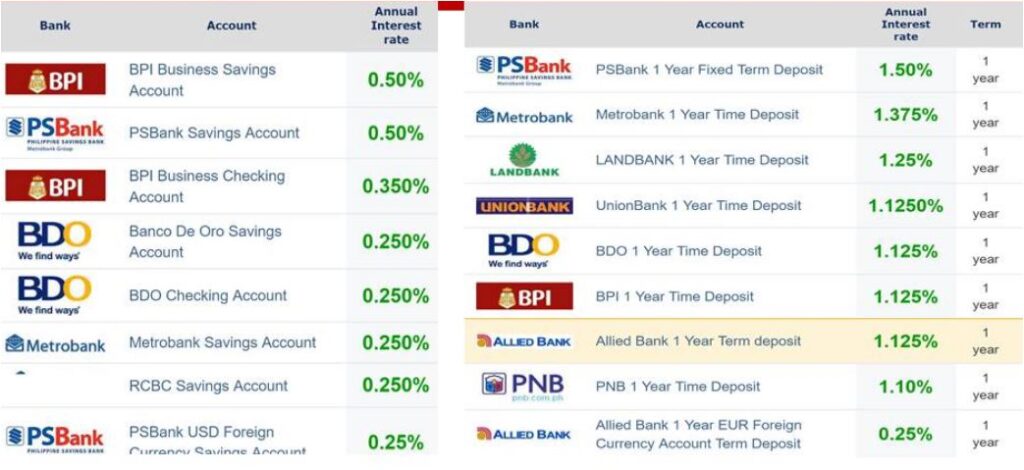

Basic savings account will not be able to beat inflation at the current fast pace of its increment. For most banks in the Philippines below is the current list of interest rates when you park your money in the bank, you can see it below, as you see there’s no bank currently giving 4-5% interest rates.

3. Increase your Wealth

There are different ways to increase your wealth. You can do this too while you are working. By being diligent to your work, you can get promotion which translate to increase in salary. This helps a lot to augment the inflation that we experience, but then again promotion only comes after few years of working hard and assuming the company notices your achievements.

Investing is one of the forms of increasing your wealth, since we know that working in companies and with our salary we can only provide for basic needs, so you need to save any excess from it and make it work for you.

Investing in the market does not need to have very large capital at the start, investing means taking small portions of savings and gradually accumulate shares on the market especially during this time when all of them are mostly at there lowest level.

Don’t worry if you do not know what to do if you are new to investing in the market especially in the Philippine context, I created this site for that purpose alone.

And as you know as well, those that are wealthiest are those that invest and do business but not those who are workers like us.