VISTA REIT gets the nod from PSE officials yesterday as it is expected list its shares by June 15,2022. Its final offer price will be determined by May 25, 2022. This content is updated to reflect the current IPO price and shares to be sold to the public, significant changes have been noted since then.

Secondary shares will be listed at initial price of Php 1.75 /share. There will be an offering up to 2.75 billion shares with an overallotment of 250.0 million shares. Proceeds of the offer will be re-invested by its sponsors in the Philippines. The IPO price is 30% lower as compared from its initial P2.50/share

Villar is expected to receive Php 4.81 billion with the full allocation sale including its overallotment shares. Public float will then be at approximately 36% from the original proposal of 49%. From the previous 9.15Billion full allocation with 3.66Billion shares, it was slashed to 2.75Billion shares

According to its website description;

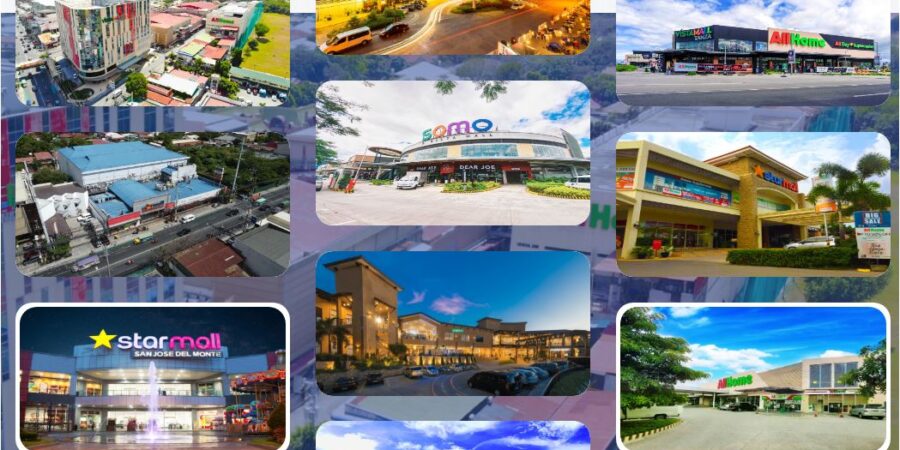

VistaREIT (VREIT) is a real estate investment trust backed by Vista Land, a leading integrated property developers in the Philippines and the largest homebuilder in the country overall. Vista Land operates its residential and commercial property development businesses through its six distinct business units, Camella Homes, Communities Philippines, Crown Asia, Brittany, Vista Residences and Vistamalls. Previously known as Vista One, Inc., VREIT is a wholly owned subsidiary of Vista Land, maintaining a diversified portfolio of commercial and office properties strategically located within Vista Land integrated communities.

The listing will include 10 property and malls in Metro Manila, Cavite, Rizal, Bulacan, Pampanga, Cebu and two of its office buildings in Taguig and Bacoor, Cavite.

VREIT’s portfolio with over 250,000 square meters of gross leasable area consists of 12 properties: 2 PEZA-registered office buildings located in BGC and Molino, and 10 retail malls with strong and stable anchor tenants including publicly listed AllHome and AllDay. VREIT operates as a Real Estate Investment Trust in compliance with Republic Act No. 9856, otherwise known as the REIT Act of 2009.

REITs provide a good source of dividend income for investors at it is mandated to return back 90% of its earnings in the form of dividends. Typically the dividend is higher to corporate dividends following the above requirements. If you want to learn more about the previous REITs and its basic function you can go to the links highlighted.

| Item Photo | Cost (Php) | Item Description |

|---|---|---|

Click Here to View Click Here to View | 456.0 | Original Portable Hanging Neck Fan Rechargeable Usb Mini Fan Electric Fan Headset Fan Outdoor Sports |

Click Here to View Click Here to View | 1,399 | OPPO Band B1 Bluetooth Watch 1.1-inch AMOLED Screen Continuous SpO2 Monitoring 50M Water Resistance |

Click Here to View Click Here to View | 5,290 | realme C11 2021 (2+32GB) |

.png)