Table of Contents

Last Updated on: October 29, 2022

One of the tools needed by a trader to successfully monitor trading results is by journaling or recording all trades that you are executing.

There are different journal nowadays that are available in software format. You just need to encode your stock name and entry and exit levels and you can have the software analyze it. We will cover later also the automatic recording of trades on these software but for now and for my case I am still inclined to do the manual recording of trades as I want to have full understanding of what is happening.

For this article you will learn the 6 basic requirements of a trading journal and how to interpret the results so you can have an assessment of your trading performance

Why do you need to make a Trading Journal

By knowing how your trades were performed and recording it down on a file so you can easily visualize what was going on for these trades ,it can help you improve your trading skills. Trading is all about skills experience and psychology. Either the trading is successful or a failure, be sure to understand your psychology or behavior so you can prevent great mistakes again later or replicate good trades for consistency.

I have made a lot of mistakes during my trading journey and recording it was included as I don’t really record it for my at least 2 years of doing my trading journey, and of course results showed I don’t know how I was trading the market so most of my recorded data when I finally decided to study why I kept on losing to the market and backtrack my transactions, its clearly visible what I was doing was wrong.

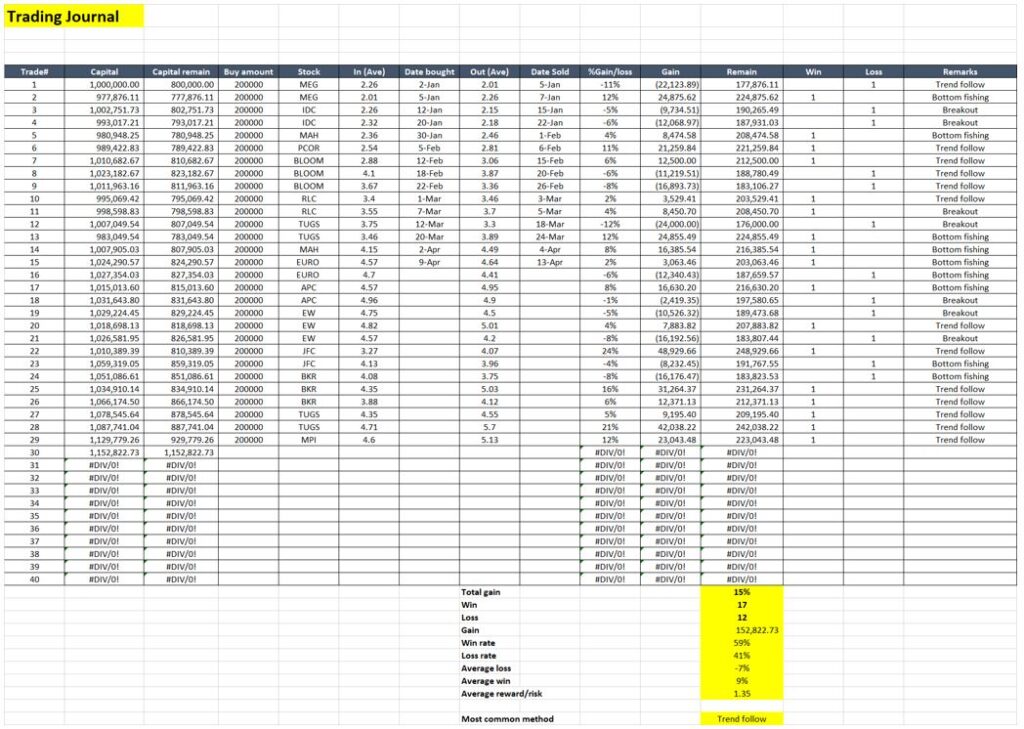

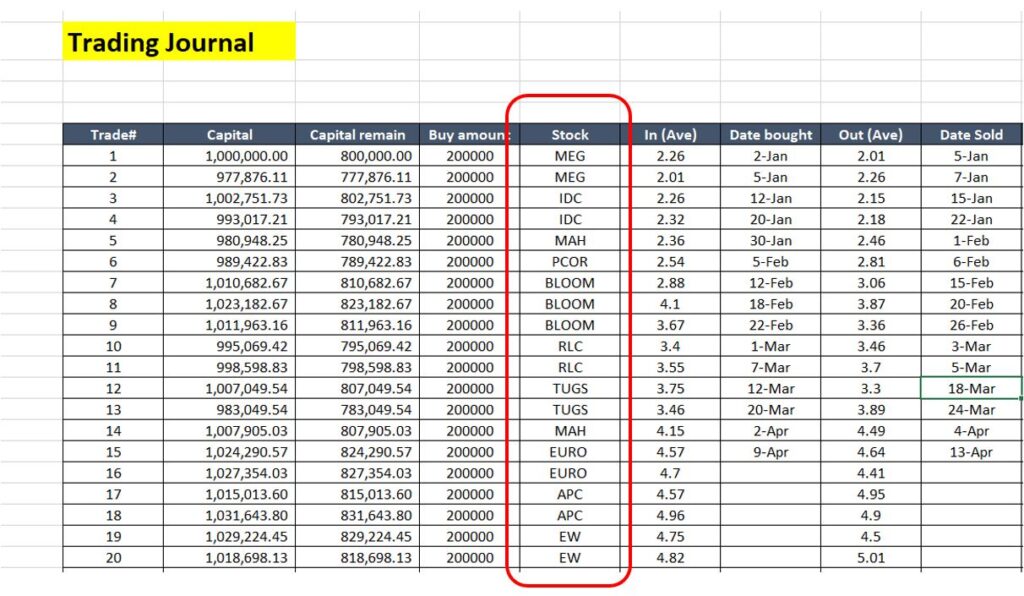

Let us discuss a sample of a journal format I am using for my trades. I have listed here basic items to be included when you are deciding to make your own format. At the end of our discussion, I will put a video link explaining the journal and a downloadable link for excel file so you can just customize it later. I am not a good excel programmer so you can just check the formulas I put on it. In some case to get the accurate data, you need drag the rectangular range of formulas to include more data if you have more trades than the sample I am uploading.

If you are not used to excel, you can try other means like notebooks or notepads as long as you can record your trades and do the necessary calculation.

This article will guide you through the requirements. I know that most of my viewers or readers are beginners or are trying to improve their performance so I’ll make as simple as I can.

Parts of My Trading Journal

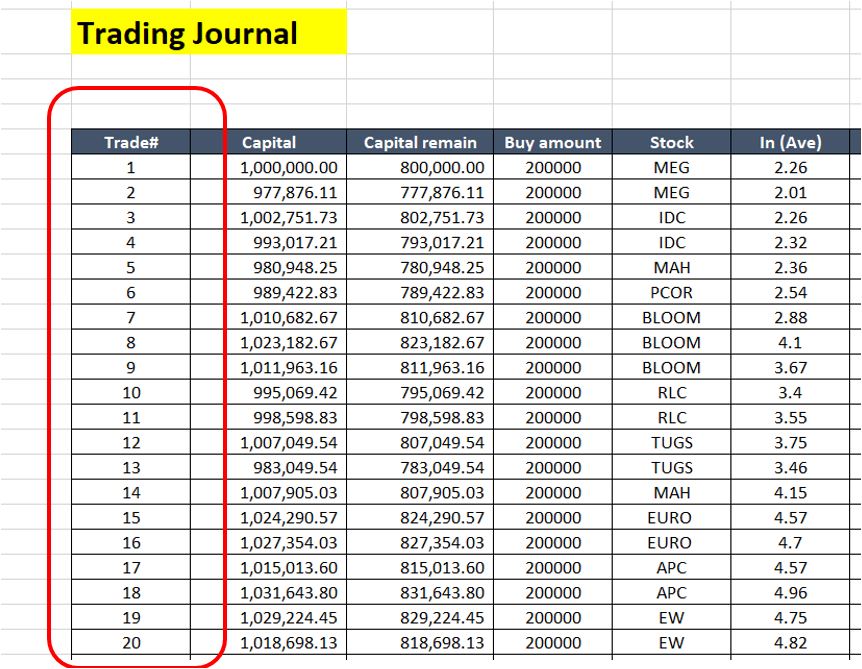

1. Number of Trades (# of trades)

There is a need to record how many trades you are executing either for a month or for a year of your transactions.

You might not see this during initial days of trading but the more you trade the market, the more you lose from it. Besides on the commission charges that will entail a lot of cost (at least 1.19%, for every transaction) when you trade more, there is a big chance that you can catch a big losing trade even if your entry signals are not flagging out any risk, this is when the market conditions like now that we have pandemic, the market can suddenly turn to downside direction without a notice.

You can see from the attachment above that this is the first column I put on my journal

So these record number of days will tell you whether you are overtrading the market. For my case more than 20 stock trades per month is already considered as overtrading.

2. Capital

A record of how much you are investing will let you know in the journal whether your investment is being successful or not. Is your capital loosing to fast, maybe you need to act now to cut your losses or are you gaining to fast on a trade so it might be prudent to take profits now.

Treat stock trading or investing as a business and not use it to treat it like you are gambling. If you trade or invest with a strategy and you do what you can to maintain your capital is a business. If you are losing its either your skill is not good enough or market conditions are not good at this time.

Capital is everything especially on trading as this is your lifeline for your future gains, so you must protect it at all cost, either you take a loss now or take short profits rather than taking big losses. The Capital has compounding effect if you trading performance is good and the opposite is true it can lead to significant losses if you are not careful with your trades

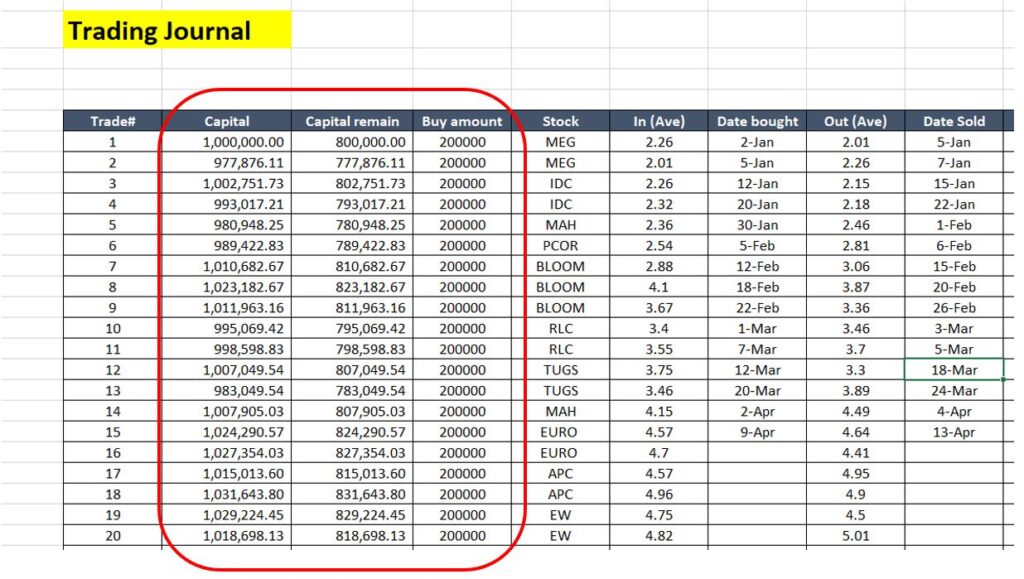

For the journal on capital, I have put in here 3 columns, Capital, capital remain and Buying amount for each stock.

In the journal this is calculated immediately. You can check the formula later from the downloadable excel file. Capital is your entire portfolio amount, capital remain is the result of deducting the buying amount from your capital

Base on your record you can see also if you are over allocating on one trade. You will need to learn how you diversify your stocks later and check if you have proper allocation for each trade.

Your record therefore on the trading journal is very insightful once you use it properly to manage your investments.

3. Stocks You buy

This is the section where we record the stock code or name of the stock we are trading so you can trace the chart patterns later of the stocks where you have entered the trade.

It is important to know later when backtracking your records whether you have the tendency to buy a penny stock or fundamentally good stocks. They have different treatments or rules considerations when trading each type. For example, blue chip stocks move very slowly and an up move of 5% in a day is already significant entailing a bullish signal. Penny stocks on the other hand at the right timing can have gains of over 20% in a day, but of course the trading risk is higher and the opposite can occur as well.

So be sure to note whether you are taking too much risk on speculative stocks.

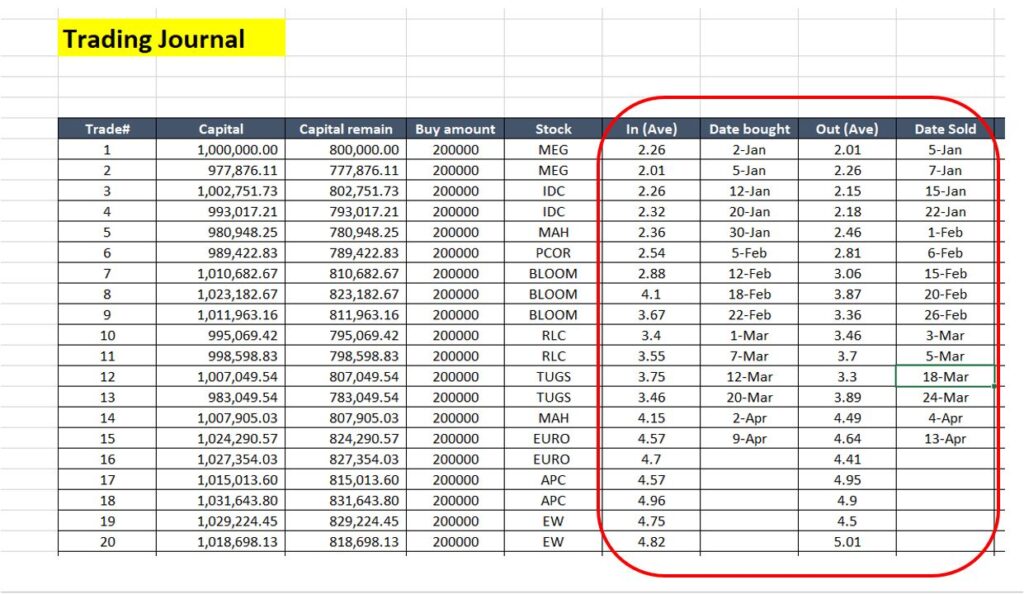

4. Price in, out and Traded Date in, out

This part of the journal will include the amount you buy or sell the stock, and the dates when you took the trades.

These are included so you can later calculate how much gain/loss occurred when you entered or exit the trade. The price when you enter and exit the trade will tell a lot of story.

Did you buy at the right time or not? Questions like this can have an answer when you look back at the charts when these trading occurred.

When you completed a trade, it is now time to reflect whether one complete transaction was executed properly or not. This is your feedback mechanism, which I was mentioning at the start of our discussions.

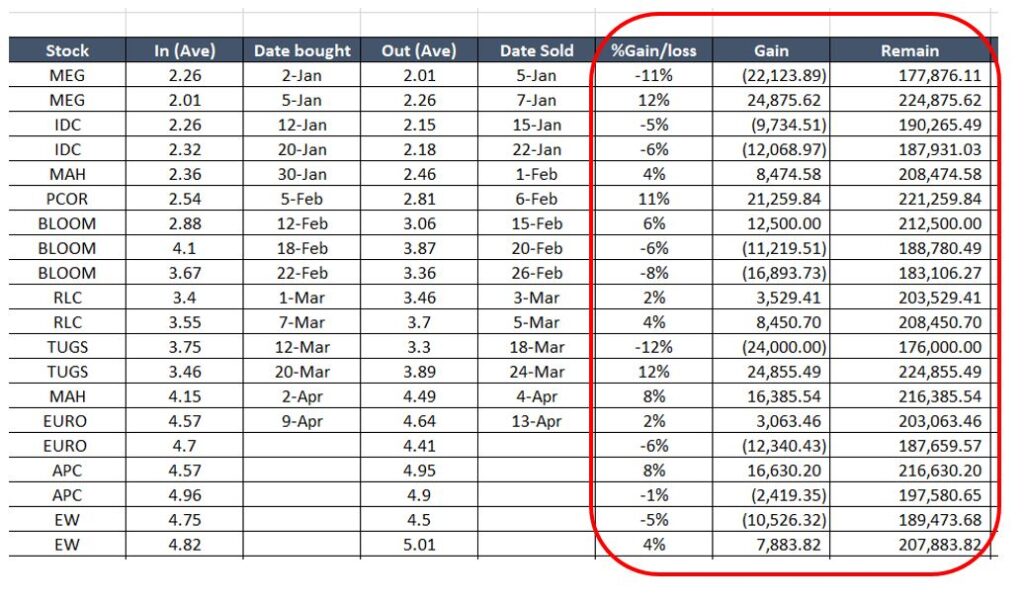

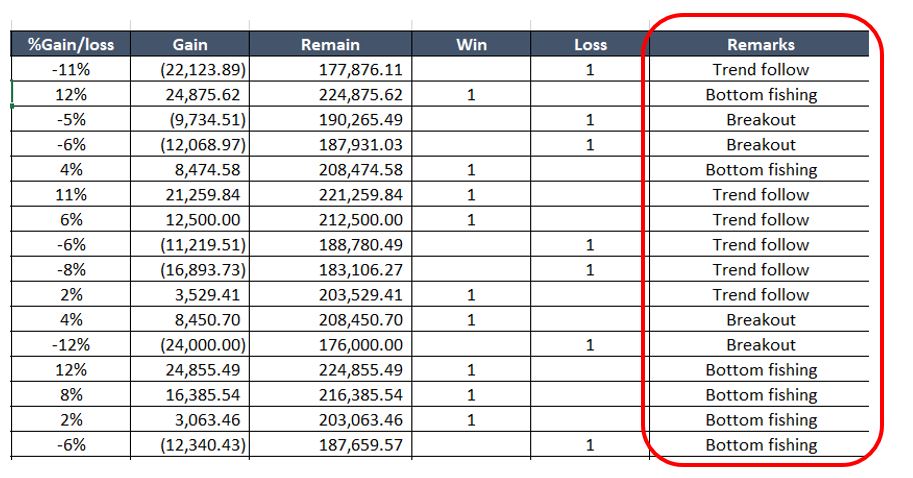

The results of calculations for the gain/loss is reflected on the next columns

%Gain/loss – how much you earn or loss on this trade

Gain- is the calculated amount, parentheses is default for loss

Remain-Buy amount minus Gain/loss, you will be able to know what is the outcome of your capital

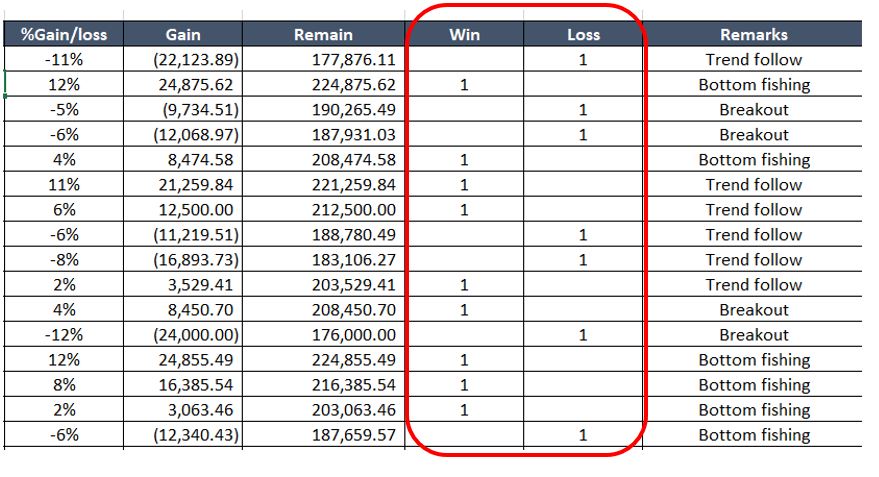

5. Win/Loss count

This part of the journal is to just count how many wins or loss you encountered for your trades. There will be some calculations later to summarize your trading performance and this is very important.

Of course our goal is to win as much as we can, but inevitably every trader (no exemption) will encounter a loss as we could not 100% predict where the market is headed, but keeping in mind that we need to win more than we loss is important.

6. Remarks

For this section you can add or customize what other data you want to record so that later when you review your journal it will have some significant contribution or effect on your performance. Here I have put the different methods trades are using to enter a trade.

This is just an example so later on as you progress as a trader, you can have varied techniques you can use.

Trend follow- this is when a trader uses a strategy that follows the overall chart move

Breakout- is when the prices move above a consolidation level

Bottom fishing-picking the stocks when the price is at the bottom

Ok so now we have all the basic requirements of a trading journal, we will now discuss the interpretation of the 6 basic parts of the journal.

At the bottom of our journal is the summary of the results once you encoded all the necessary requirements of the trading journal.

Total gain refers to the % gain/loss you have for all your trades. This tells us whether we are being profitable as a market trader or investor. Of course our main goal is to have a positive number so that the time we invested will not go to waste.

Win and Loss are the count or number of wins and trades you executed. From this data we can calculate the Winning rate and losing rate.

Base from our sample above you can see that to have a gain for our overall portfolio you need to have a higher winning rate that your losing rate.

Average loss or Average win is the averages of your loss and wins. Once you download the excel file you can check how I manually search the fields need to included those that are losing together or those that have gains together.

Base on this. The trades I have has an average loss of -7% and a winning average of 9%. So as long as I can maintain my cut loss below 7% there is a chance I could be profitable on my future trades. Assuming of course that I have a strict discipline on this matter.

Average reward risk is simply the ration of average win to average losses. A value greater than 1 is always preferred.

Now you remember that the remarks section I put strategies from my trades and it turns out I excel at doing Trend following. So in the future if I follow the same direction there is a chance I could be profitable.

Now you have seen how powerful a trading journal is to a trader or investor in the market. You can see your overall performance and have a prediction on which direction you should go to succeed on this type of business. Its what I used to learn the curves and risks of the market.

I hope you have learned a lot on this article.

If you think I can still help you to become better, you can check my membership section. I do train people who want to learn more on the market or those who are struggling to learn how to invest or trade in the market properly. You can check it out.

Download the excel Trading Journal Here

Watch our Video on Trading Journal

You might Also want to Read:

Range Trade in SM Investments : 12,572Php Gain

Thanks Sir for sharing your method of preparing a trading journal. May question lang po ako on the buying amount portion if you trade in tranche buying and selling. But your format really helps. Hopefully maayos ko rin po yung trading journal ko. More than one year na po ako continuously doing the trading, and my porfolio still in red. he..he..he.. I keep on studying and watching in youtube to gain more knowledge. Nag-member po ako sa investagrams para matuto ng mga tamang trading strategy. Anyways, salamat po muli sa mga toppics nyo sa youtube. God bless!

Thanks Vic. Pwede mo sya i-modify naman add rows nalang para sa stock transactions or just put yung total average price mo.

Bro, saan makita na website yung performance ng listed companies, for their earnings, sales and profits at iba pa.

Thanks,

Will consider this type of info for next uploads.

Thanks for your inputs

Sir may template ba kayo sa tax at commission sa buy and sell?

Keep grinding guys