Emperador (EMI) was recently included in Singapore Straits Times Index , which is a milestone for Billionaire Andrew Tan’s company and EMI is the first Philippine Listed Stock to do so.

EMI replaced Comfort DelGro as constituent in benchmark Straits Times Index

EMI price move up significantly during the day and help improve PSEI market sentiment. At the close EMI share price is 20.85php/share.

In its lates disclosure in PSE edge it states that “Emperador Inc., a global spirits company, takes another historic milestone as it officially joins major global companies in the Straits Times Index (STI) after meeting all the eligibility requirements. Emperador’s inclusion in the STI, which is the first for a Philippine company, will take effect at the start of trading on September 19, 2022”

STI is a market capitalization weighted index that tracks the performance of the top 30 companies listed on the Singapore Exchange (SGX). It is widely followed by investors as the benchmark for the Singapore market. There are only 30 stocks listed on the STI index so this is really a good news for the company.

The inclusion of Emperador in the STI will expose the company to a larger base of institutional and retail investors as well as active and passive funds. Inclusion in the STI is a testament of Emperador’s consistent outstanding performance through the years.

Emperador (EMI) was granted eligibility to list in SGX last April 13,2022. Majority of shares ( 84.57%) is own by Alliance Global Group (AGI).

The constituents of STI will be updated by September 19 to reflect inclusion of Emperador.

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my website so I can continue to provide you with free content each week!

Click Here to View Click Here to View | Buy 1 Take 1 Lucky Powerbank Sense4 10400mAh Power Bank | ₱280 76% OFF |

Click Here to View Click Here to View | Rapoo S1005 10000mAh Powerbank Li Polymer Dual Output Fast Charge Slim Portable Powerbank Original | ₱389 - ₱399 57% OFF |

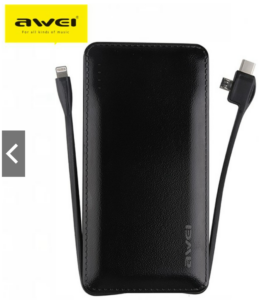

Click Here to View Click Here to View | Awei P51K Lithium Polymer Super Thin Portable Powerbank 10000Mah | ₱730 51% OFF |