Table of Contents

(Last Updated On: )

Blue chip stocks are so called best companies in the Philippine market today. They have been selected by the Philippine Stock Exchange to represent the best companies in the country. They are the stocks that represent the Philippine Stock Exchange Index or PSEI.

If you want to know what we think are the current list of Blue chips stocks in the Philippines worth looking at and investing today’s market conditions you can check our Blue chips Stock Picks today.

Blue chip stocks are being reviewed every year from July of the previous year to the month of June of current year. The final list of the 30 stocks are announced normally during August period

These stocks are normally giving good dividends as these companies have a good recurring income. These are big companies and easy to identify in the public as these are brands most notable to many. For example Jollibee foods corporation, Banco De Oro, San Miguel Corporation and the like.

To be able to be considered as a blue chip or the cream of the crop of the stocks, it must meet at least 3 minimum requirements duly reviewed by the Philippine Stock exchange.

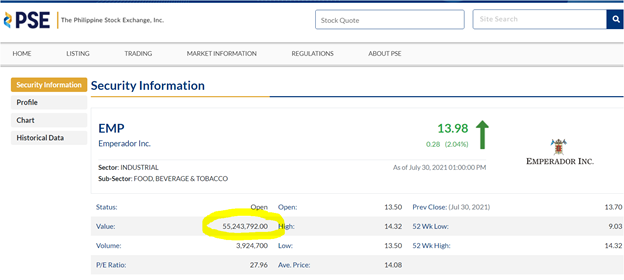

1. Liquidity

- The company should be among the most traded companies. This criteria selects the Top25% in median traded value in 9 out of 12 months

You can see below the traded value (amount in pesos) for the day of Blue chip stocks Emperador (ticker symbol EMP)

An advantage of this is that you can get in and out of the stock anytime because a lot of investors and traders are buying and selling the stock any time of the trading hours

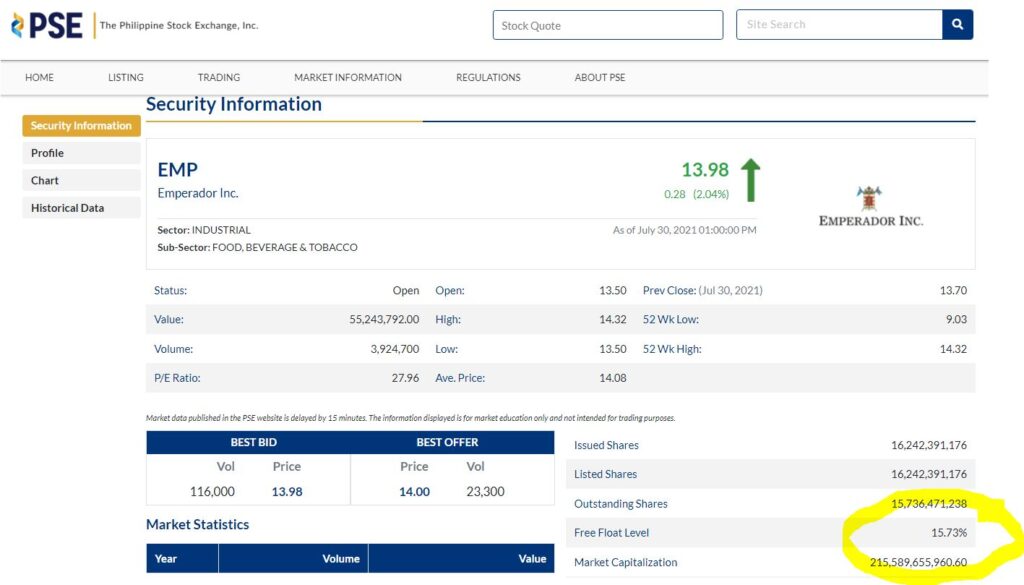

2. Highest in market Capitalization

- The company should be the biggest in market capitalizations

This is to ensure that the company is strong enough to whether the economic situations that might occur, like the pandemic that we are having now.

You can see here that Emperador has a Market capitalization of 220Billion pesos. It’s a very big company.

Market capitalization can also be computed by the current price of the stock multiplied by the total Market shares available for that stock.

3. Market Float level is >12%

- The company should have the shares invested in public be greater than 12%.

For the company to be remain in the stock market it should have at least 10% free float level of the equivalent shares that the public can invest in the total amount of capitalization of the market

You can see here that Emperador has a free float level of 15.73%. Once this value becomes lower than 10% the Philippine stock exchange will not allow public to invest on the company so make sure the one you are buying have greater than 10% public float.

Blue chip stocks are very important index category of the stock market. If majority of these stocks are going down in direction, it means that the economic condition of the country may not be good and those can give a signal that it is not the correct time to invest in the market. The opposite therefore is true that if these stocks are going up in direction, it’s the best time to buy and ride the trend.