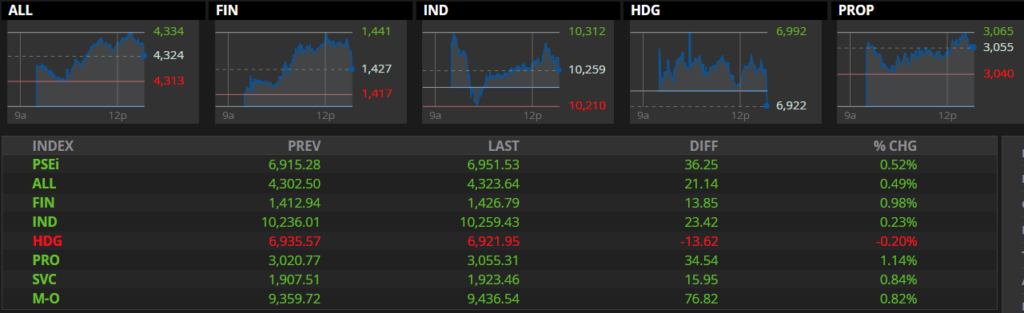

The Philippine market stayed on course and up for the fourth day again with a gain of 0.52% as Banko Sentral ng Pilipinas (BSP) release its monetary rates benchmark policy rate at its lowest level of 2% to support economic recovery in the country. Overnight deposit and lending rates were also maintained at 1.5% and 2.5%, respectively.

PSEI index closed at 6,951.53 level with net foreign selling of -352Million. Foreigners is keeping the index just below 7,000 level with massive selling at pre close period.

For the Blue chips sector, ACEN(4.65%) led the group together with CNVRG (4.65%). CNVRG is the most actively traded stock.

1ACEN 4.65%

2CNVRG 4.29%

3PGOLD 3.74%

4RLC 2.82%

5BDO 2.07%

6AP 1.87%

7AC 1.87%

8RRHI 1.42%

9MBT 1.35%

10GTCAP 1.24%

11SMPH 1.23%

12AGI 1.17%

13MEG 1.06%

14ICT 1.04%

Index sector showed that property and industrial sector led the group.

BSP Kept Interest Rates at its lowest level of 2%

BSP kept its interest rates at the low levels to maintain its support for Philippines economic recovery as the expectation of inflation cause by low supply of commodities will cause prices to spike up in the future. This has been announce yesterday during their briefings.

Central bank governor Benjamin Diokno stated during this press release that “Together with appropriate fiscal and health interventions, keeping a steady hand on the BSP’s policy levers will allow the momentum of economic recovery to gain more traction by helping boost domestic demand and market confidence”.

Last month inflation data peak at 4.9% which is already much higher than the BSP estimate of around 4.4%. Benjamin Diokno has attributed this case due to African swine fever that hit the production of meat products and the continuous effects of the storms that have entered the country.

BSP’s next meeting for policy rates would be in November 18 and December 16 of this year.