The PSE market continued its winning streak as the index stayed above the 7,300 level during the day trading. The market ended with a gain of +0.2%, still bullish as the previous day covid cases drop again below 4k level. According to OCTA research group, the covid levels are at situation where we will be at stage before the upsurge of the Covid cases.

The PSE index ended 7,311.72 at with a net foreign buying of +303.8Million. It remains to be seen whether we can sustain this level, but the presence of foreign buying is helping.

For the Blue chip index, pre close upsurge of AEV (5.45%) and LTG (5.35%) help the market retain its green position. Correction is still happening for CNVRG (-5.36%) and BLOOM (-4.41%).

| Gainers | Losers |

| 1AEV5.45% | 1CNVRG-5.63% |

| 2LTG5.35% | 2BLOOM-4.41% |

| 3ICT4.57% | 3BDO-3.51% |

| 4MPI2.96% | 4WLCON-3.45% |

| 5GTCAP1.96% | 5ACEN-3.37% |

| 6AGI1.29% | 6PGOLD-2.64% |

| 7SM1.27% | 7RLC-2.15% |

| 8AP1.10% | 8SECB-1.98% |

| 9JFC1.05% | 9GLO-1.64% |

| 10MER0.95% | 10BPI-1.28% |

| 11AC0.92% | 11TEL-0.98% |

| 12MEG0.64% | 12JGS-0.23% |

| 13URC0.50% | 13MBT-0.20% |

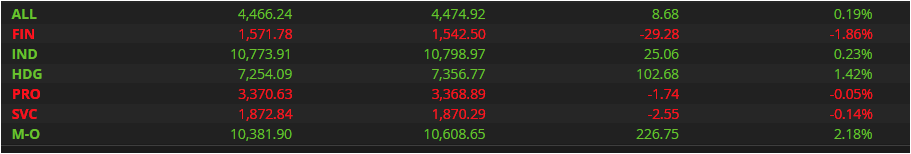

For the index sector Mining led the group movement with Benguet Mining (BC, 13%) closing. Decliner led by Finance sector with Banco de Oro (BDO, -3.51%) pulling back.

COVID CASES back at Pre-Surge Level

According to OCTA research Professor Guido David the seven day average is less than 6,500 cases and its nationwide level of reproduction rate is at low of 0.55. Spokesperson Harry Roque cites business establishments and activities allowed amid the implementation of alert levels system.