After reaching more than 7k level for the past 2 days, the broader share index dropped significantly to -1.5% yesterday due to large net foreign selling (-1.47Billion). Market movers like Converge ICT have been on the run for the past 2 weeks and have risen significantly. It dragged the index as CNVRG dip by as much as -14% on yesterdays closing.

The index closed to 6,951.30 with majority of the index stocks in red. The index chart is having a heavy resistance above 7,067.

For the Blue chip index stocks, Converge ICT (CNVRG, -14.77%) led the bearish movement followed by FGEN (-8%). FGEN negative sentiment is coming from its removal from the Blue chip index due to the lower (<20%) public float after an investor move to buy up more of its share from the market. Wilcon (WLCON) which is set to replace FGEN rose by as much as 25% during the intraday trading managed to close at +8.45%. Wilcon (WLCON) is set to join the index by October 11, 2021.

CNVRG -14.77%

FGEN -8.00%

LTG -5.24%

GLO -4.99%

AEV -4.59%

JGS -3.86%

DMC -3.26%

Converge ICT Drops by -14.77%

Converge ICT led the market correction. It had one of the most traded value of 1.91Billion pesos and largest number of trades of the day with 23.52K shares exchanging for the day.

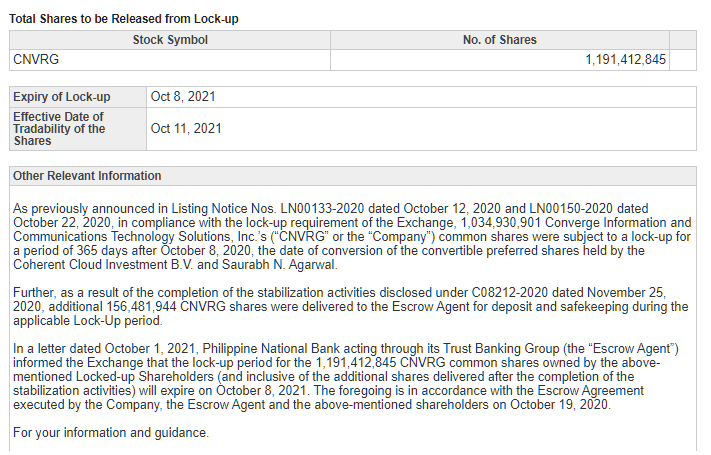

There have been discussions among trading community as well on the possible impact of the release of its lock up period from its investors. The lock up expiry of Converge ICT (CNVRG) will expire by October 8, 2021 and these lock up shares of 1,191,412,845 will then be tradable at the exchange by October 11,2021.