Philex Mining recently sign a Term sheet with Macawiwili Gold Mining and Development Co., Inc. (“MGMDCI) as PX sets its goal of expanding its current mining coverage.

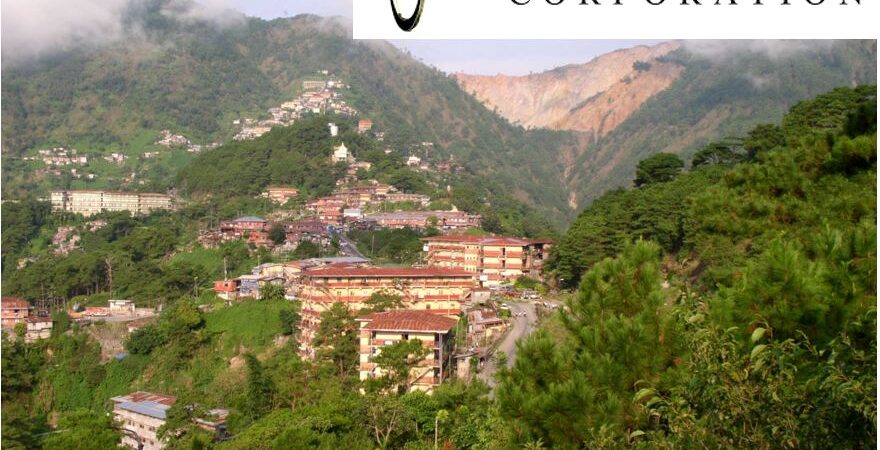

Macawiwili Gold Mining and Development Co., Inc. is a 90-year old company engaged in mineral exploration and production in Itogon, Benguet.

Macawiwili has more than 800 hectares of contract area under its mineral production sharing agreement (MPSA). Macawiwili has exploration projects in various mineral deposits such as gold and copper.

The Term Sheet outlines the parties’ clear intentions to explore commercial, financial, and technical avenues in preparation for possible shares acquisition by the Company in MGMDCI. Activities to kick off this partnership will include conduct of due diligence and scout drilling activities on the property of MGMDCI covered by Mineral Production Sharing Agreement (MPSA) in Itogon, Benguet Province., located adjacent to the existing Padcal Mine of the Company.

Signing the Term Sheet on behalf of the Company were Manuel V. Pangilinan, Chairman, and Eulalio B. Austin Jr., President and CEO; while representing the shareholders of MGMDCI were Michael G. Escaler, Jose Ma. S. Lopez, and Felicisimo A. Feria. The signing was also witnessed by directors and officers of the Company as well as counsel for both parties.

According to Eulalio B. Austin, Jr., President and CEO,

“Our interest to pursue investments in the Macawiwili property” “is part of our business direction for this year to broaden interest in ‘green metals’ through mergers and acquisitions.”

“We need to hit the ground with this at the soonest possible time,” Austin adds, “considering that this property is adjacent to our Padcal mine and would go a long way in fulfilling company plans for expansion and extension of the life-of-mine of Padcal.”

“This is a good addition or extension to the Padcal Mine,” according to Manuel V. Pangilinan, Philex Chairman. “I hope that this is the start of something good and that it would ride the wave of higher metal prices in gold and copper.”

Pangilinan emphasized that “any addition, expansion, or extension to the Padcal Mine would greatly benefit not just our employees and their families, but also our host and neighboring communities, and our nation as a whole.”

Share price of Philex mining is currently trading at 3.25pesos/share as of the time of this writing.

Source: PSE Edge (https://edge.pse.com.ph/openDiscViewer.do?edge_no=73336067e3308bf09e4dc6f6c9b65995)