After a bullish sentiment yesterday night from the US stock market, PSE market followed its que and was up the whole day with a gain of +2.65% at the closing. A very strong close we have not seen from last months trading. Is this a bullish reversal?

PSE Stock following US stock based on CPI data?

The US CPI data was released last week and based from the news, it closed at 8.2% for September. This is slightly lower than last months CPI record which is 8.3%. It drop by one tenth of a percentage points. We will have to guess whether this is the effect of the aggressive interest rate hikes by the Fed which spur sell off in the riskier assets like the stocks.

The PSE market index close at level 6,128.64 with a net foreign buying of 728.25 Million. Finally the market reach 6k level after its bottom below 5.7k level.

On the index side the property sector (+4.20%) led the market movers for the day. Majority of indices of the market are on the positive territory as well.

INDEX PREV LAST DIFF % CHG

PSEi 5,970.33 6,128.64 158.31 2.65%

ALL 3,198.63 3,253.51 54.88 1.72%

FIN 1,502.31 1,544.01 41.70 2.78%

IND 8,693.45 8,754.59 61.14 0.70%

HDG 5,763.54 5,891.82 128.28 2.23%

PRO 2,597.20 2,706.27 109.07 4.20%

SVC 1,529.48 1,563.53 34.05 2.23%

M-O 10,651.20 10,753.08 101.88 0.96%

For the blue chip index JGS (11.3%) led the gainers together with the property stocks like ALI (7.72%) and MEG at 5.42% while there are only 4 losers of the Blue chip index.

GAINERS

1JGS 11.30%

2ALI 7.72%

3AC 6.39%

4MPI 6.02%

5MEG 5.42%

6MBT 4.85%

7GLO 4.82%

8BDO 4.24%

9GTCAP 3.14%

10SMPH 3.03%

11MONDE 2.89%

12ICT 2.67%

13AEV 2.59%

14PGOLD 2.55%

LOSERS

1MER -2.24%

2SM -1.63%

3CNVRG -1.56%

4SMC -0.10%

The ASIAN markets followed the bullish move as well today, majority of the indices are in the positive side of the market.

| Symbol | Name | Last Price | Change | % Change |

| ^N225 | Nikkei 225 | 27,156.14 | 380.35 | 1.42% |

| ^HSI | HANG SENG INDEX | 16,827.23 | 214.33 | 1.29% |

| 000001.SS | SSE Composite Index | 3,076.63 | -8.32 | -0.27% |

| 399001.SZ | Shenzhen Index | 11,177.67 | 15.41 | 0.14% |

| ^STI | STI Index | 3,022.03 | 6.28 | 0.21% |

| ^AXJO | S&P/ASX 200 | 6,779.20 | 114.8 | 1.72% |

| ^AORD | ALL ORDINARIES | 6,976.20 | 121.9 | 1.78% |

| ^BSESN | S&P BSE SENSEX | 59,002.46 | 591.48 | 1.01% |

| ^JKSE | Jakarta Composite Index | 6,847.29 | 16.18 | 0.24% |

| ^KLSE | FTSE Bursa Malaysia KLCI | 1,392.31 | 6.04 | 0.44% |

| ^NZ50 | S&P/NZX 50 INDEX GROSS | 10,847.34 | 61.42 | 0.57% |

| ^KS11 | KOSPI Composite Index | 2,248.36 | 28.65 | 1.29% |

| ^TWII | TSEC weighted index | 13,124.68 | 158.63 | 1.22% |

| ^GSPTSE | S&P/TSX Composite index | 18,621.02 | 294.67 | 1.61% |

US market yesterday closed with Nasdaq (3.43%), S&P500 (+2.65%) at and Dow jones (1.86%). US dollar strength seems to have come to a halt for the last 2 days.

| Symbol | Name | Last Price | Change | % Change |

| ^GSPC | S&P 500 | 3,677.95 | 94.88 | 2.65% |

| ^DJI | Dow Jones Industrial Average | 30,185.82 | 550.99 | 1.86% |

| ^IXIC | NASDAQ Composite | 10,675.80 | 354.41 | 3.43% |

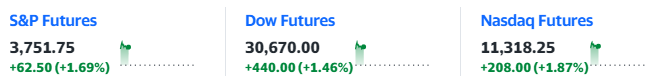

US Stock futures are pointing to a bullish market tonight as well.